You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dow losing almost -1000 Friday .. when will it end? Do we get a V recovery?

- Thread starter cyber888

- Start date

aja8888

Moderator Emeritus

I was looking to buy in some more stock funds but was expecting stocks to go a little lower before pulling the trigger, and then there's a big jump today. Oh well, I'll hold off again.

Don't worry, there will be big drops again. Maybe even tomorrow as Big Names are being CRUSHED in after hours trading.

pacergal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We have been out of the market for 70% of our investments for the past two months, wanting to really simplify and consolidate. We wanted to move our retirement accounts out of work plan, it has been a s***s***, between employer and plan manager getting things correct and to our new place. Finally ready to reinvest, so this might have been a good thing, time wise. Maybe.

Don't worry, there will be big drops again. Maybe even tomorrow as Big Names are being CRUSHED in after hours trading.

You called it - VTI down 3.67% with Amazon down 14% today. Brutal day/week/month for equities, especially tech and small/mid caps

Don't worry, there will be big drops again. Maybe even tomorrow as Big Names are being CRUSHED in after hours trading.

You were right. And an even bigger drop today than I expected. It kept falling late.

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,991

No idea about anything. But if equities truly tank >40% I'll scrape the bottom of the barrel and invest some cash. Meanwhile I still won't touch the LMP.

Flyfish1

Recycles dryer sheets

We have been out of the market for 70% of our investments for the past two months, wanting to really simplify and consolidate. We wanted to move our retirement accounts out of work plan, it has been a s***s***, between employer and plan manager getting things correct and to our new place. Finally ready to reinvest, so this might have been a good thing, time wise. Maybe.

You " timed " it well. Wait a bit and start buying in tranches over time.

IMO: Anytime the S&P is substantially under it's 200 day SMA it's a great time to buy.

Love This Community

Recycles dryer sheets

I am DCA’ing into the market. Still in the accumulation phase and heavy into stocks. I guess these drops will test my tolerance level. So far enjoying the ride

tmm99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 15, 2008

- Messages

- 5,224

Wow, I've been buying VTI, but it is now lower than what I bought it at... I guess I will need to buy some more but I don't know how much more it will fall...You called it - VTI down 3.67% with Amazon down 14% today. Brutal day/week/month for equities, especially tech and small/mid caps

aja8888

Moderator Emeritus

Thursday's rally was nothing more than a short squeeze as shorts were covering. Today was a continuation of the revaluing of the high flyers. More to come, especially if the FED stays hawkish next week and raises the FFR 0.5%. Even oils got beat up today.

I flew to Texas a couple weeks ago to check on the AgedP for her 89th birthday, and then have been busy, so I've been waiting for an upday to peek/gasp at the portfolio.

But it looks like about time to put some of that cash to work (used about 15% of cash about 3 months ago? when the market was down about 6%). I was up to 19% cash and I might be back there, based on what the market seems to have been doing this month. The "strategery" is to put cash to work every 5-7% down.

Admittedly, it's probably easier and longterm beneficial to just keep everything in stocks/cash and just let it ride, but I don't like being full-in when PE/prices keep soaring to the moon; nibbling off a percentage of gains is nice, until DW and I hit Full Social Security Age and start drawing SS. I hit that in 2.5 years, so it isn't very long now!

But it looks like about time to put some of that cash to work (used about 15% of cash about 3 months ago? when the market was down about 6%). I was up to 19% cash and I might be back there, based on what the market seems to have been doing this month. The "strategery" is to put cash to work every 5-7% down.

Admittedly, it's probably easier and longterm beneficial to just keep everything in stocks/cash and just let it ride, but I don't like being full-in when PE/prices keep soaring to the moon; nibbling off a percentage of gains is nice, until DW and I hit Full Social Security Age and start drawing SS. I hit that in 2.5 years, so it isn't very long now!

Closet_Gamer

Thinks s/he gets paid by the post

As we're saving for a beach house, I'm accidentally hedged with a boat load of cash on the sidelines.

Might I hope for an epic crash in the next six months?

Leave me enough to pay cash for a house AND put money into a cratered stock market?

If everyone on this board would simulateously try to sell everything they own right about September 1, I would really appreciate it!

Might I hope for an epic crash in the next six months?

Leave me enough to pay cash for a house AND put money into a cratered stock market?

If everyone on this board would simulateously try to sell everything they own right about September 1, I would really appreciate it!

Lcountz

Recycles dryer sheets

Good time to do a Traditional to Roth conversion....!

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

While I hoped that earnings growth would reduce the overvaluation of the market, between high inflation, recent earnings announcements and the likelhood of a recession, I'm increasingly skeptical that the market can grow its way out of overvaluation... I'm not very bullish in the short term.

No idea about anything. But if equities truly tank >40% I'll scrape the bottom of the barrel and invest some cash. Meanwhile I still won't touch the LMP.

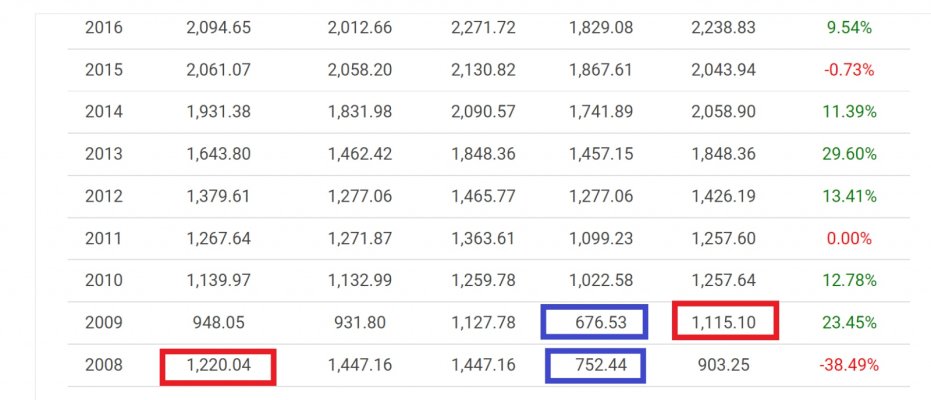

In 2008, the S&P tanked -38% .. although you can see the lows of 2008 and 2009 where it tanked to -50%. But at the close of 2009, it was back to around 91% of the beginning of 2008. S&P was 1220 at the beginning of 2008 and 1115 at the end of 2009. These 2 years were very volatile with S&P hitting 676 and 752 but moved back up quickly above 1000+. We had a real recession in 2008-2009. Now, we have inflation. I hope it's not worst.

Attachments

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Good time to do a Traditional to Roth conversion....!

Did ~1/3 of my 2022 targeted Roth conversions yesterday. Of course, time will tell if I'm brilliant or an idiot.

While I hoped that earnings growth would reduce the overvaluation of the market, between high inflation, recent earnings announcements and the likelhood of a recession, I'm increasingly skeptical that the market can grow its way out of overvaluation... I'm not very bullish in the short term.

I'm in the complete other camp on this....76% of companies in the S and P 500 have beaten earnings estimates compared to the norm of 66%. Re inflation , money supply has slowed this year markedly after a very steep rise--historically one precedes the other and we are already seeing commodity prices, freight rates, car and oil prices decline.

In terms of valuation we are now at ~18x forward earnings, thats not significantly high and finally when you add to the fact that investor sentiment readings this week are the lowest since March 2009 I think we are ripe for violent upswings eventually and possible very soon.

JoeWras

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 18, 2012

- Messages

- 11,730

Whee?

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My guess is that as long as bitcoin remains above 10,000, the market will not drop below S&P500 of about 250 at worst.

When people start really selling every high risk volatile asset, I will get worried. I bet we get buyers next week around 390.

When people start really selling every high risk volatile asset, I will get worried. I bet we get buyers next week around 390.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The government is trying to combat inflation by raising rates (good) but in the same instant they are working to keep spending high. Currently quite a few states discussing or implementing stimulus even though unemployment is low and businesses are not having enough workers to keep supply lines up. They also have suspended repayments on student loans, even for people of means, which allows those people to spend that money in the economy on the limited selection of goods. There is now talk of eliminating a significant amount of the student loan debt, which means you would be foolish to pay down your loan right now and instead are motivated to spend that money. It sounds great for the economy and certainly has helped the stock market reach higher highs, but seems to directly lead to the current inflation trend.

I don't know where or how this ends if you turn off one tap but open another. Seems you still might flood the house.

I don't know where or how this ends if you turn off one tap but open another. Seems you still might flood the house.

F.I.R.E User

Thinks s/he gets paid by the post

I am down $-$71k from 2021 October highs. All my natural DCA since then is going to pay off in the long run right?

aja8888

Moderator Emeritus

I am down $-$71k from 2021 October highs. All my natural DCA since then is going to pay off in the long run right?

Depends on what you call the long run.

As an example, I am almost 79 so I look at the long run as maybe 10 years. I have two dead friends this year already and one was 79, the other 85, both were healthy and were in my golf group until the strokes and other things hit.

Look at Japan's 30 year run after the stock market crashed in 1990 or thereabouts. We can be Japan-like too if our government decides to run their banking system the same way.

F.I.R.E User

Thinks s/he gets paid by the post

Depends on what you call the long run.

As an example, I am almost 79 so I look at the long run as maybe 10 years. I have two dead friends this year already and one was 79, the other 85, both were healthy and were in my golf group until the strokes and other things hit.

Look at Japan's 30 year run after the stock market crashed in 1990 or thereabouts. We can be Japan-like too if our government decides to run their banking system the same way.

I am 44. I retire between 55 and 60. All equity portfolio.

aja8888

Moderator Emeritus

I am 44. I retire between 55 and 60. All equity portfolio.

Well, you have a lot of time and are still working. Good for you.

W2R

Moderator Emeritus

Whee?

After reading this thread, and noticing that the Dow is at 32,977, I'm wondering if it's more like

[1/Wheee!!!]

But then, my crystal ball is broken so who knows.