Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

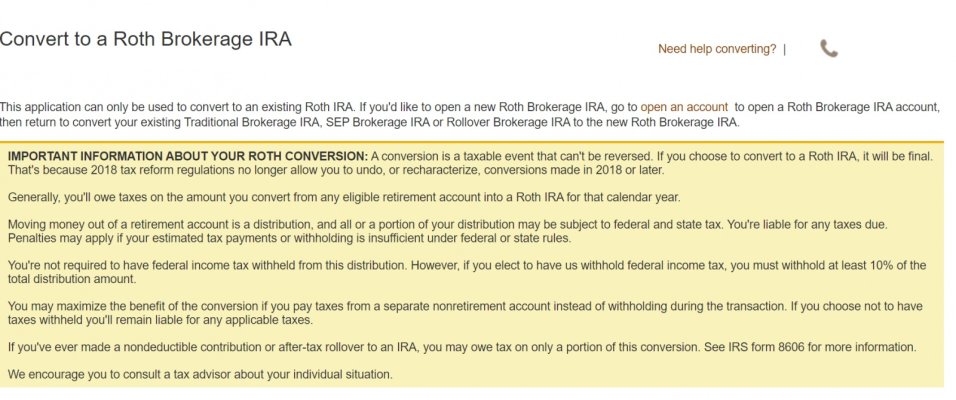

Background: Earlier this year I briefly took some dividend distributions from my TIRA, and Vanguard sent withholding to federal and state, though I don’t remember being asked? This is the reason for my question.

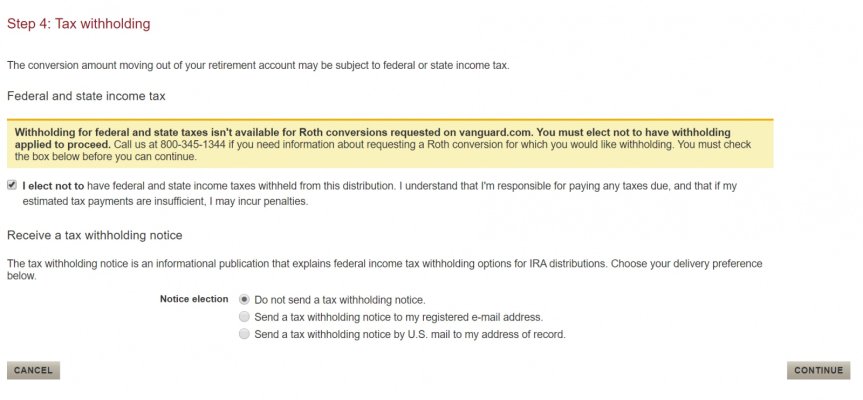

Now: I am beginning large Roth conversions from my TIRA to a Roth IRA. I want to pay all taxes from our taxable account, not from tax deferred IRA. When I set up the Roth account and did a test $1K conversion, there was a mention that Vanguard wouldn’t withhold. But before I convert a large amount, I’d feel better if I could see that set somewhere, preferably online, and I can’t find anything. I assume it’s irreversible if they withhold. I called and a random Flagship rep told me there would be no withholding, but when I told him Vanguard withheld from my dividend distributions, he acted surprised - not reassuring.

Anyone know how to confirm Vanguard will NOT withhold for federal or state conversions on TIRA distributions>Roth conversions? Or do I hope the rep knew what he was talking about. I’m not feeling that confident with VG lately after they sent snail mail re: my accounts to my sister...

Now: I am beginning large Roth conversions from my TIRA to a Roth IRA. I want to pay all taxes from our taxable account, not from tax deferred IRA. When I set up the Roth account and did a test $1K conversion, there was a mention that Vanguard wouldn’t withhold. But before I convert a large amount, I’d feel better if I could see that set somewhere, preferably online, and I can’t find anything. I assume it’s irreversible if they withhold. I called and a random Flagship rep told me there would be no withholding, but when I told him Vanguard withheld from my dividend distributions, he acted surprised - not reassuring.

Anyone know how to confirm Vanguard will NOT withhold for federal or state conversions on TIRA distributions>Roth conversions? Or do I hope the rep knew what he was talking about. I’m not feeling that confident with VG lately after they sent snail mail re: my accounts to my sister...

Last edited: