Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

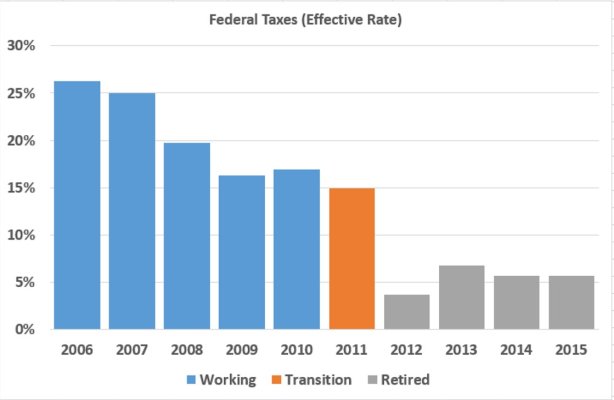

There was a thread a few weeks ago from a newly minted retiree who was surprised at how low his/her taxes were. I remember being shocked, even felt guilty, the first year I did my return after retiring. Or course I knew my marginal bracket/effective tax rates would be lower, but after decades paying relatively high taxes - the actual numbers came as a shock the first year into retirement. I triple checked that return, convinced I must have missed something - but I hadn't.

Americans in the 15% bracket and below have NOTHING to complain about, especially given the break on dividends & capital gains.

Since I finished my 2015 returns yesterday, and for me a picture/data is worth a thousand words...

Americans in the 15% bracket and below have NOTHING to complain about, especially given the break on dividends & capital gains.

Since I finished my 2015 returns yesterday, and for me a picture/data is worth a thousand words...

Attachments

Last edited: