You said:

"This helps explain why the inadequacies and injustices of our domestic economy have become major points of conflict - there really is a lot less growth: While rate of increase in profits has continued to climb steadily without the underlying GDP growth to back that up, the money has to come from somewhere, and it comes from wages."

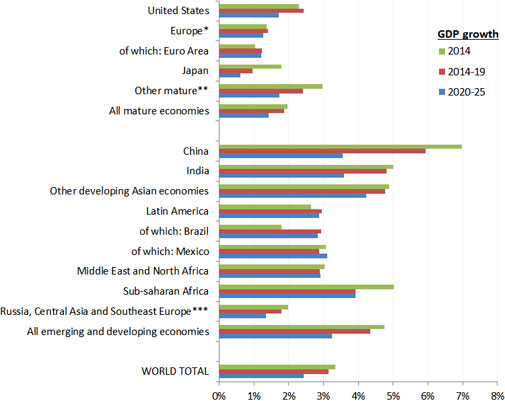

I don't come to your conclusion from this chart or by skimming the accompanying article. The chart says that the source is projecting GDP growth rate to increase in the U.S. and Europe, slow down in China and India and stay about the same in the rest of the world. Assuming that you can believe this (most of these projections are about as good as darts in a dartboard) its probably good news for American workers as wages usually go up with GDP.

Its no surprise that China and India's GDP increase has been much faster than the U.S. for the last 10 years or so. They're starting from a much lower per capita base and are still way behind the U.S. According to the IMF per capita GDP published in Wikipedia

List of countries by GDP (PPP) per capita - Wikipedia, the free encyclopedia , the U.S. per capita GDP is just short of $50,000 and China's is just over $9,000. I don't know about you but I'm much happier getting a 2% raise on $50K income than a 7.5% on $9K. Its about the same increase but its much more fun to live on $50K.

Its no secret that our rate of growth has been hammered by the 2008 recession and hasn't recovered. Its also no secret that corporate profit increases haven't been passed on to U.S. workers yet. But China's rate of growth isn't a cause. IMOP, its another symptom of an underlying phenomenon that low cost transportation and China's shift from a closed to a more open society have changed competition from national to global. Eventually, the cost of overseas wages + the inefficiency cost of 10,000 mile supply lines will rise enough to make U.S. labor competitive again. When this happens, corporations will move manufacturing back to the states. We're already seeing this with Apple, Caterpillar, and I'm sure a lot of other corporations.