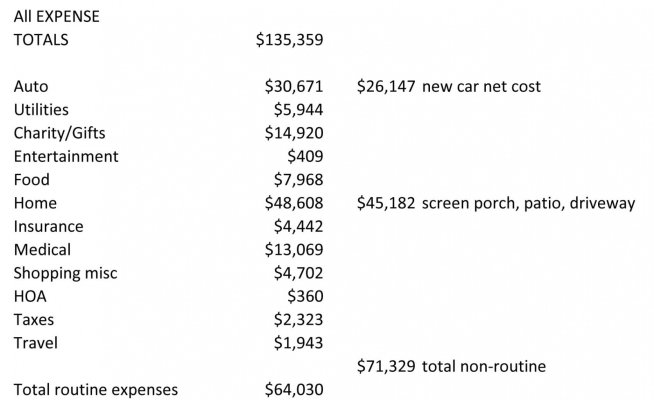

I won't know until a few days in the new year, the year is not over and it takes a few days for my credit card expenses to go from Pending to Final. I use Personal Capital (now Empower) to track my expenses, you can export a CSV file that you can then massage in Excel as needed.

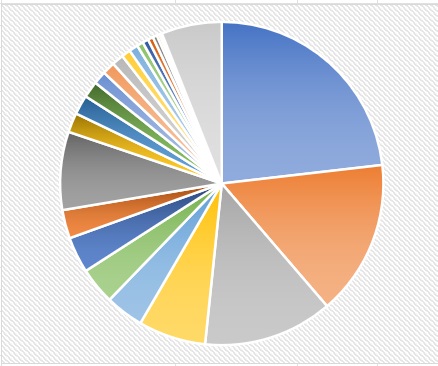

I have a spreadsheet that shows a pie chart of categories (Mortgage is still #1, #2 is usually groceries or travel, but "groceries" is pretty broad category for us: anything from Costco is automatically classified as "groceries" but I may have bought a pair of boot and some dishwasher soap along with actual food items for example.

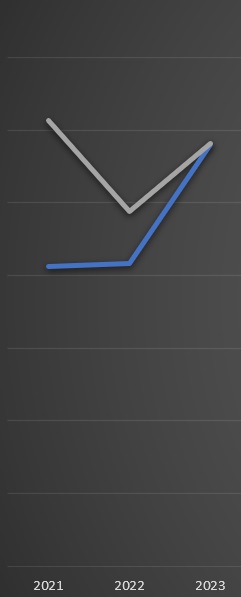

I also track year-over-year (blue line) and adjusting for inflation (gray line). That shows that once adjusted for inflation, I spent more in 2021 and less in 2022 than I will likely have spent in 2023, so my spending is staying flat after inflation, which is mostly how I want it.

Tracking where your money goes helps you make the best choices of where to spend it (I'm always happy to see travel as 10-15% of our spending!) and where you could make choices to reduce (wow, I spent a lot on alcohol in 2021, and as a result decided to quit the 2 wine clubs that were sending us stuff regularly. It's more fun to go to tastings and buy stuff when you truly like it)

I'm about 4 years from retirement so this tracking is very important to me, it will help me understand what to expect in retirement. We still have a kid living at home, so some of those related expenses will go down, but I'm also planning on spending even more on travel in retirement. I'm sure things will change over time, but that's the best I can do with the info I have!

Since I'm still employed, I am tracking the cost healthcare (dark gay pie slice) as provided by my employer, knowing they pay a large percentage of the actual premium, so I also know some of those things will change. The mortgage (blue slice) will be paid off when I retire, so what we currently pay towards it will likely go to healthcare (a quick look at ACA for my state seems to indicate it will be more than enough), knowing that only the P&I will go away but insurance and taxes remain...

Home improvements like a new water heater or new flooring are part of my yearly expenses, but rather than have large lump sums for cars, I added a "sinking fund" (top gray slice) that is roughly what I expect the cost of a new car to be, amortized over 10 years (x2 cars, not sure we'll keep 2 in retirement, but planning on it at first).

Kid in college is also off the tracking spreadsheet, so actuals were higher by quite a bit, but still socking away 30% of my gross income, getting so close to FI!

Looks like my spending for 2023 is up somewhere between $20K-$25K more than my 2022 spending.

Looks like my spending for 2023 is up somewhere between $20K-$25K more than my 2022 spending.