Hello all,

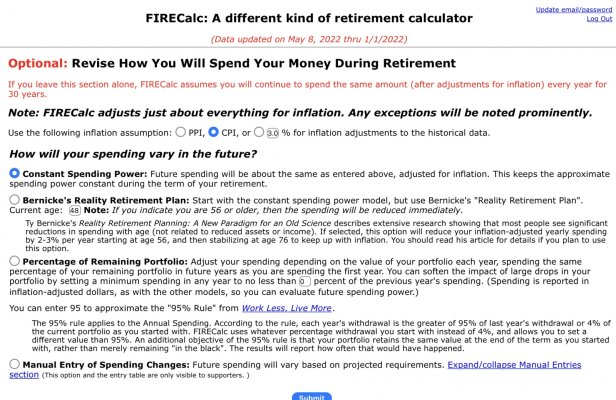

Is there any way to model required minimum distributions on firecalc? I have a Traditional ira that I have been taking withdrawals to reduce the balance and also starting to do yearly conversions to a Roth IRA. I just turned 69 and only have until 72 when rmds start. I also have another Roth account and a taxable account. I want to convert as much as possible while staying in a acceptable tax bracket. I believe taxes will rise in the future. I will be taking social security at age 70. Between two pensions, two social security accounts, and savings I’m trying to keep my adjusted gross income below the. IRMAA thresholds and minimize my Rmd withdrawals. Also considering if a QLAC would be helpful as the premium would reduce my traditional ira balance (and also my Rmd). Comments are appreciated.

Is there any way to model required minimum distributions on firecalc? I have a Traditional ira that I have been taking withdrawals to reduce the balance and also starting to do yearly conversions to a Roth IRA. I just turned 69 and only have until 72 when rmds start. I also have another Roth account and a taxable account. I want to convert as much as possible while staying in a acceptable tax bracket. I believe taxes will rise in the future. I will be taking social security at age 70. Between two pensions, two social security accounts, and savings I’m trying to keep my adjusted gross income below the. IRMAA thresholds and minimize my Rmd withdrawals. Also considering if a QLAC would be helpful as the premium would reduce my traditional ira balance (and also my Rmd). Comments are appreciated.