Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

CAPE has been a(unhealthy?) fascination of mine for quite some time, but have always been disappointed with any idea pursued. There is just something unseemly about this use of accounting numbers that are based on GAAP rules that change over time that that slowly accrues a pit in my stomach to the point where I have to unwind the fascination before too long.

Hadn't searched for CAPE investment ideas in a while before reading this post, but found the venerable Dr. Damodaran has a couple of relatively recent blog posts that are interesting food for thought for CAPE-crusading market timers.

Musings on Markets: Mean Reversion: Gravitational Super Force or Dangerous Delusion?

Musings on Markets: Superman and Stocks: It's not the Cape (CAPE), it's the Kryptonite(Cash flow)!

Things that make you go hmmm...

Apologies in advance to those who find any parts of this post of this punny. Bad week at w*rk and this post is, unfortunately, my outlet.

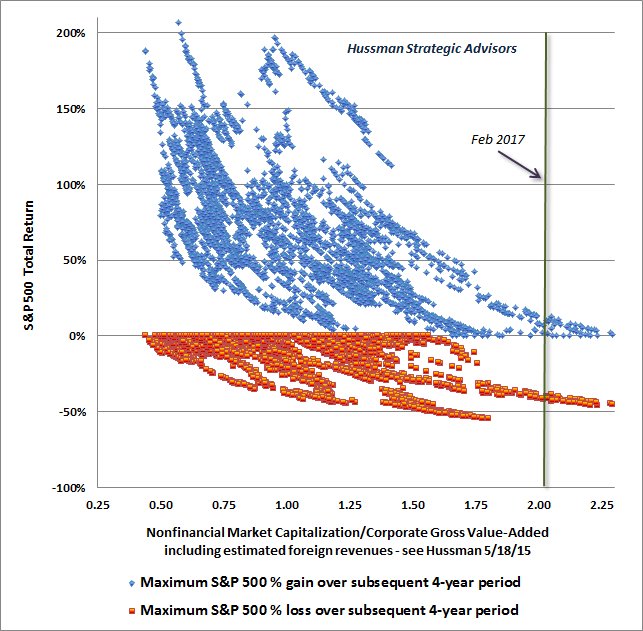

The good Doctor amuses me with his cash flow valuation techniques that he favors --- he perceives he can value Apple and buy at $115 as undervalued and sell at $135 as fully valued a stock with so many entanglements it boggles the mind. He amused me even more when he values Valeant in 2015 at $208 when it was trading at $200 or when he valued it at $42 when Valeant traded at $32, he is just like all the good bull market salesmen for hedge funds looking to sell people that they understand a companies business model exactly and can price the value of the business today at a dollar figure. To watch the justifications as a stock price drops 90 percent and to be able to display an exacting confidence that you know to the dollar what a business is worth is very … amusing….. perhaps the most amusing thing to me was the surety of his valuation of Valeant’s asset in place as being worth more than $110 per share at a time when Valeant wasn’t reporting proper accounting techniques or whether intercompany sales and cost of sales as well as inventory were properly valued. Never does he try to describe whatever happened to the $95 per share of assets already in place, not being based on future growth.

Current Price per share = $180.00

Number of shares outstanding = 344.90

Do you want me to adjust trailing numbers for Salix acquisiton? No

Drop in operating income from pricing fix 0.00%

Expected growth rate for high growth period = 3.00% Length of period in cell B21

Input page

Market inputs for your company

Market Capitalization = $62,082.00

From the balance sheet This year Last year

Book value of equity = $6,464.70 $5,312.00

Total Debt Outstanding = $30,883.30 $15,253.90

Cash & Marketable Securities = $1,420.00 $322.60

From the income statement

Revenues $9,990.10 $8,263.50

Operating income (EBIT) = $4,977.13 $3,901.19

Effective tax rate = 16.51%

Net Income $610.00

Your growth inputs

Expected growth rate in operating income= 12.00%

Return on Invested capital on growth = 19.90%

Length of growth period = 10

Your cost of capital inputs

Cost of equity = 10.17%

Cost of capital = 7.72%

Riskfree rate = 2.00%

Intrinsic Value

Value of assets in place = $53,837.35

Value added by future growth = $47,420.27

Intrinsic enterprise value $101,257.63

Intrinsic equity value $71,794.33

Intrinsic equity value per share $208.16