dobig

Recycles dryer sheets

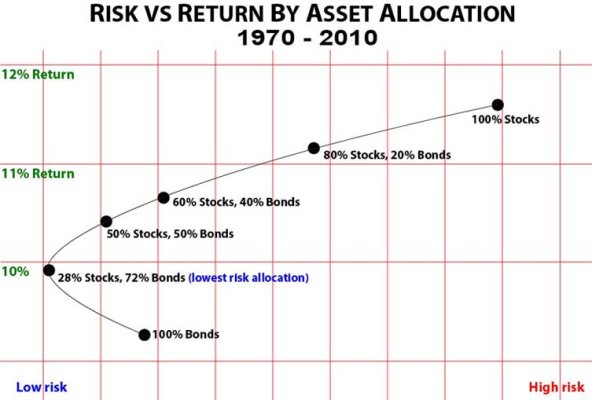

I used a number of tools (FICalc, FireCalc, Fidelity’s retirement planner) to help me determine what was the lowest level of equities I would need to have a 100% chance of my plan outlasting me. Turns out it was 0%. I don’t have to stick a dime in equities. I do, however, have about 25% in today for a hedge.

I would suggest to the OP to see exactly how much you need to make your plan work.

I get about 143% of our needed income from bond ladders. I have no heirs, only charities so that is a minor consideration for me. I sleep well at night and don’t worry about the stock market.

Glad you chimed in COcheesehead as I've followed your threads closely on the fixed income threads. Like you, we do not need our equities for retirement according to the FireCalc but it would not be a very enjoyable retirement. By my calculations, if we went all fixed income we would have an additional 200% of our needed yearly income by next year. The problem is even though that would be way more than we need according to our current lifestyle, I'd like more after the frugal lifestyle we've lived these past 30 years. We're not the type of people who would ever spend money on lavish travel or high end goods or even eating out. Just not us. We're WalMart people. But some time in the future we'd like to be in the position where if we found that perfect waterfront home down in Virginia, I'd like to be able to buy it, get a decent fishing boat and call it a day. I figure if that's what we want, we're going to have to be in some percentage of equities sooner or later.