This is not the same with Silver, here is the perceived hole in the Silver Market.

Blackrock runs SLV ETF which sells silver and supposedly holds physical silver to back the contracts, but a close read of perspectus shows they only need to hold more than 1/2 of the physical metal and can hold options or futures for the remaining contracts.

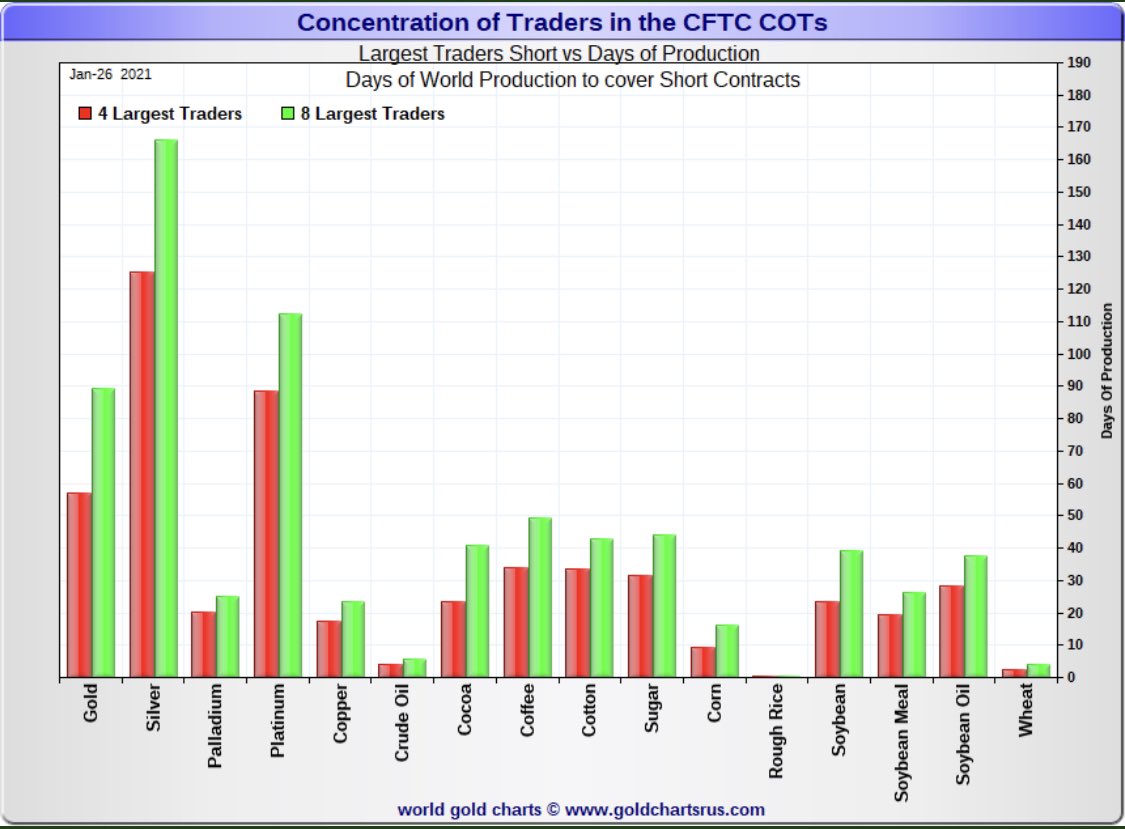

In the meantime they are also allowed to allow people to short against the Silver held in the ETF, this is the largest banks in the world. Currently they are short about 300 million ounces. By taking physical silver in hand, while at the same time buying SLV shares you squeeze the shorts and expose that SLV is not actually holding the silver, it is used to wash purchases of silver to hold the price down (someone thinks they are buying silver buys the ETF, ETF only buys 50-60% of the actual silver and a bank immediately shorts that physical silver.

By sending people around the world to buy silver there will not be enough silver to satisfy silver and COMEX may be triggered into rule 589 where no contracts of silver are allowed to process on a day where price increases by more than $12 without enough people willing to sell the silver. It is a very interesting concept.

Virtually every silver dealer in America as well as the Canadian Government has the same stock message on their websites:

https://www.jmbullion.com/silver/silver-bars/all-silver-bars/