- Joined

- Nov 17, 2015

- Messages

- 13,979

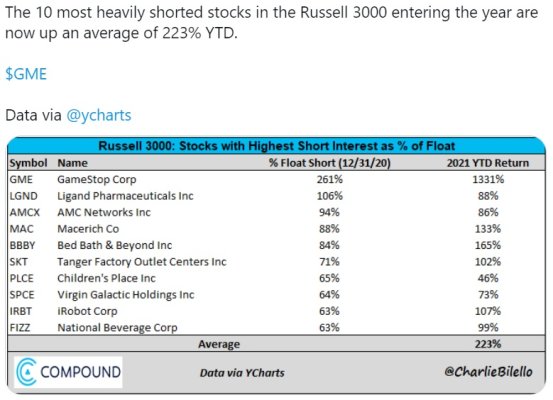

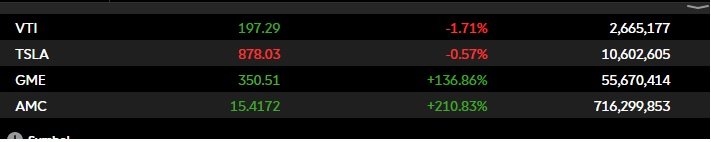

140% short position against gamestop, which means in some way there is naked shorting going on. Naked shorting is supposed to be illegal. Looks like some gamers said NO and banded together and took the Wall street big boys to the woodshed.

Not remotely just gamers. And not just gamestop, but yes it's targeting hedge funds with bit short bets.