marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,477

Thought I'd run this by our esteemed group here in case I'm missing something.

This month's Kiplinger's has an article on "Smooth Year End Money Moves", highlighting "Trim your tax bill".

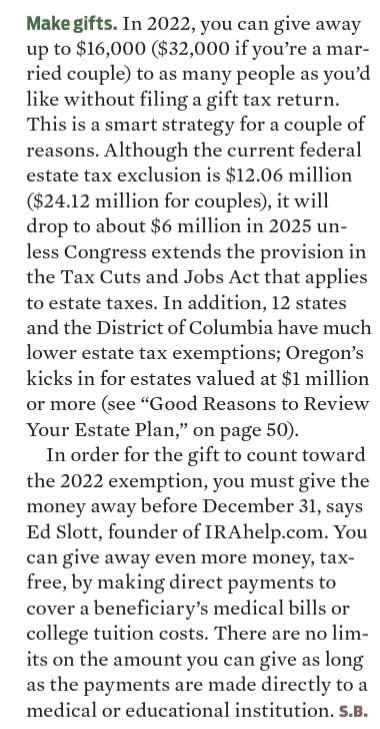

It lists things such as being aware of surprise cap gains from MFs, identify your deductible expenses, contributing to a 529 etc but also says "Make Gifts".

I must be missing something--I often am. My take is that unless a couple has plans for over $24.12 million to give away, there is no direct tax savings by making gifts.

Yes, I'm aware of the intricacies of the $16K/$32K reporting issue and the chance the Congress might drop the $12MM/$24MM exclusion to $6MM, but unless one is in that range, how does making a gift now save anything on taxes today? Even with much lower levels at the state level, doesn't all of that only become an issue at estate time?

Or am I missing something?

This month's Kiplinger's has an article on "Smooth Year End Money Moves", highlighting "Trim your tax bill".

It lists things such as being aware of surprise cap gains from MFs, identify your deductible expenses, contributing to a 529 etc but also says "Make Gifts".

I must be missing something--I often am. My take is that unless a couple has plans for over $24.12 million to give away, there is no direct tax savings by making gifts.

Yes, I'm aware of the intricacies of the $16K/$32K reporting issue and the chance the Congress might drop the $12MM/$24MM exclusion to $6MM, but unless one is in that range, how does making a gift now save anything on taxes today? Even with much lower levels at the state level, doesn't all of that only become an issue at estate time?

Or am I missing something?