With the market up (yay!) I want to rebalance, get rid of things that likely won't perform well in the future.

Quick background: I'm only about 1/3rd of the way to my FI goal and looking at about 10yrs before I reach that mark (hopefully). My AA target is about 90/10 or thereabouts but I just picked that a couple of years ago because I want to grow the portfolio as aggressively as possible given my goals and short timeframe, I'm not averse to changing it if that's the general consensus.

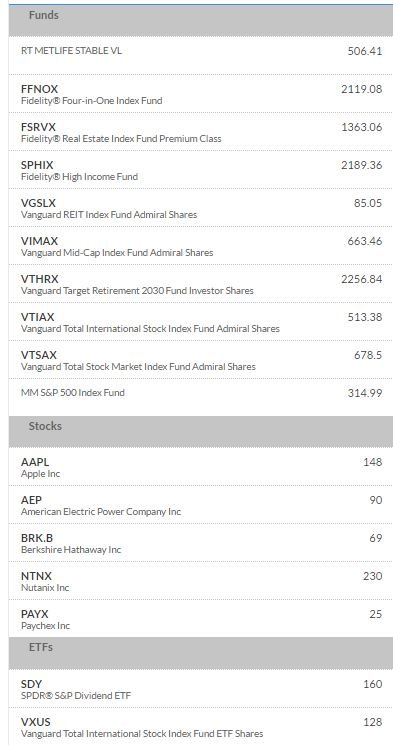

Attached is what my portfolio looks like as of this morning; a few of these(individual stocks and vanguard admiral funds) are in my brokerage so that will generate a taxable event if i sell those.

Quick background: I'm only about 1/3rd of the way to my FI goal and looking at about 10yrs before I reach that mark (hopefully). My AA target is about 90/10 or thereabouts but I just picked that a couple of years ago because I want to grow the portfolio as aggressively as possible given my goals and short timeframe, I'm not averse to changing it if that's the general consensus.

Attached is what my portfolio looks like as of this morning; a few of these(individual stocks and vanguard admiral funds) are in my brokerage so that will generate a taxable event if i sell those.