Hello, just wanted to get some advice on my current situation.

I’ve got a past 401k that I’d like to rollover somewhere so I can continue to contribute. It was a long turn job of about 18 years and has roughly 350k in it.

I have a Roth IRA through Betterment and was considering rolling it over there, although as this is almost my entire nest egg. The eggs in one basket thing does scare me a bit.

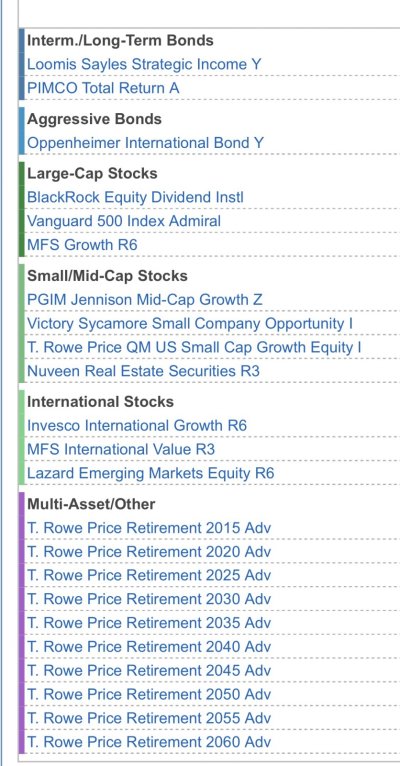

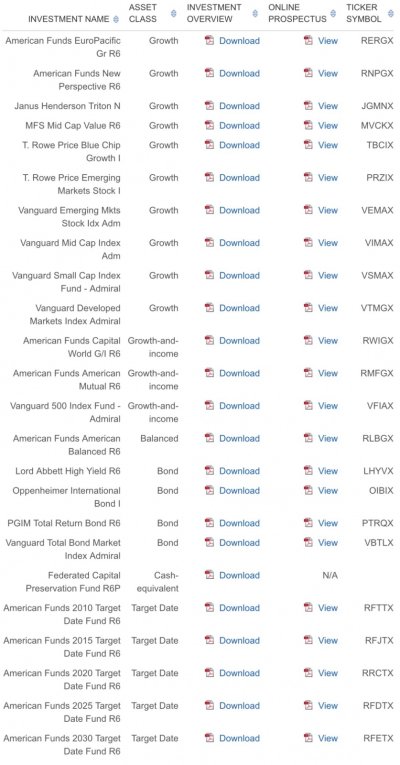

My new job’s options are slim as there best 401k fund is a vanguard S & P index fund admiral which currently is my only fund I’m in. My yearly contributions at 12%.

I would love some advice on where to rollover that 350k. I love the idea of low cost index funds, all advice is welcome. Thanks in advance

I’ve got a past 401k that I’d like to rollover somewhere so I can continue to contribute. It was a long turn job of about 18 years and has roughly 350k in it.

I have a Roth IRA through Betterment and was considering rolling it over there, although as this is almost my entire nest egg. The eggs in one basket thing does scare me a bit.

My new job’s options are slim as there best 401k fund is a vanguard S & P index fund admiral which currently is my only fund I’m in. My yearly contributions at 12%.

I would love some advice on where to rollover that 350k. I love the idea of low cost index funds, all advice is welcome. Thanks in advance