studbucket

Recycles dryer sheets

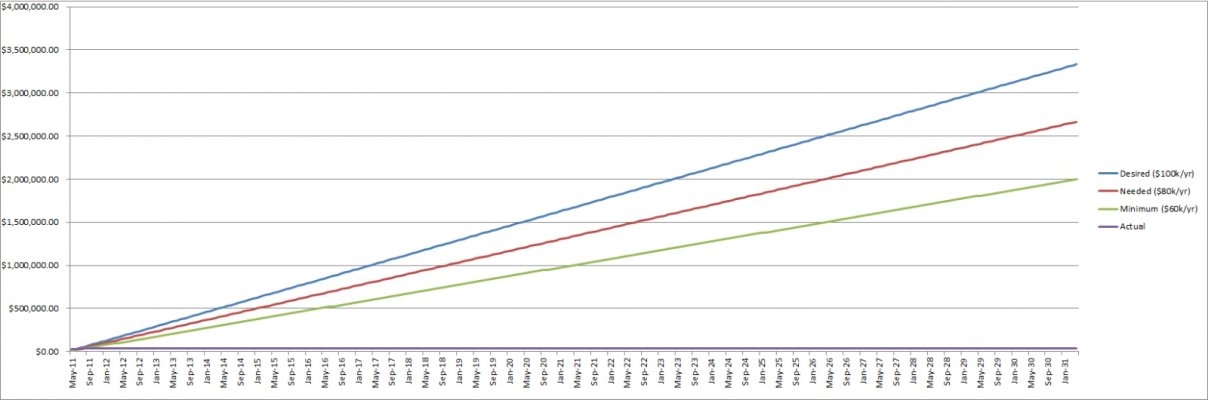

In the attached image, you'll see a graph one of the spreadsheets I've been using to track my finances, this one is specifically telling me how I'm doing at working toward retirement. Basically, I have 3 "curves" representing retirement at 64k/year, 80k/year, and 100k/year, and then track my current retirement assets against where I should be for those goals.

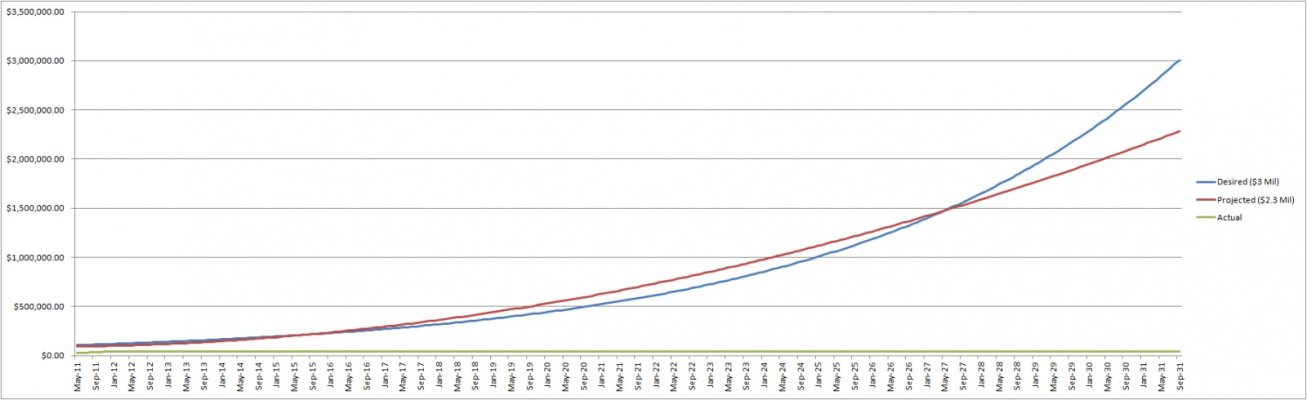

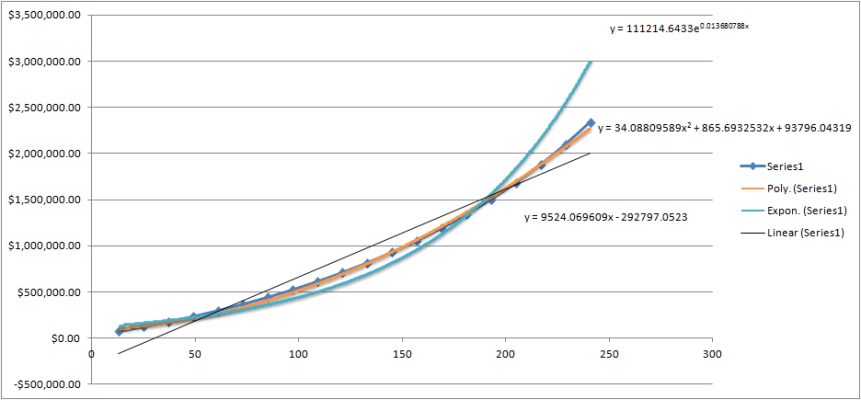

However, those goals are currently being measured simplistically and linearly. It shows that I need to be saving or making $8000/month. Right now, that's not realistic (we're saving $2-3k/month and the market is not going up). I' realized that perhaps I need some sort of non-linear formula or model to best track this, because that's more like how my money will be made. I'll be (likely) saving up a lot more 10 years from now than I am today, as I make more money.

With that background, do you know of a formula I should use to represent that. Would x^1.3 or something like that be what I'm looking for?

Thanks!

However, those goals are currently being measured simplistically and linearly. It shows that I need to be saving or making $8000/month. Right now, that's not realistic (we're saving $2-3k/month and the market is not going up). I' realized that perhaps I need some sort of non-linear formula or model to best track this, because that's more like how my money will be made. I'll be (likely) saving up a lot more 10 years from now than I am today, as I make more money.

With that background, do you know of a formula I should use to represent that. Would x^1.3 or something like that be what I'm looking for?

Thanks!