Just curious if anyone here 1) Calculates the inflation adjustment 2) Spends the inflation adjustment.

YMMV

With the solar panels and the Bolt/RAV PHEV, energy inflation is pretty much gone. That leaves food and travel, but the latter hasn't amounted to much in COVID. I wouldn't say we are inflation-proof, but it doesn't really touch us. My 89 year old mother & sister and my oldest son with 2 kids and one on the way, are wacked by inflation, so I feel lucky and we help out regularly. What are we going to spend it on--Wagyu beef? (Edit: as an answer to the question, we withdraw to the top of the 12% tax bracket and stick the unused $ into a taxable brokerage to blow or for emergencies. Later when there is no left-over we may start withdrawing the inflation adjustment.)

Last edited:

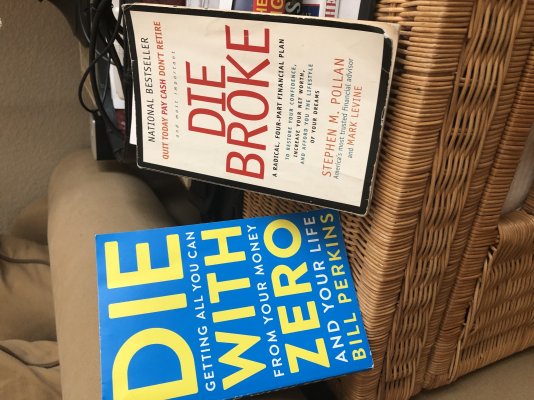

give it away Sure few assets left when I’m gone but I’m trying to spend ALL the Cash. Tried first class flights back when Virgin Air was not absorbed by Alaska nice rate! Indulge in things DW & I like. Traveling a bit more now double boosted play it safe?

give it away Sure few assets left when I’m gone but I’m trying to spend ALL the Cash. Tried first class flights back when Virgin Air was not absorbed by Alaska nice rate! Indulge in things DW & I like. Traveling a bit more now double boosted play it safe?