Hi to all FIREd and FIRE hopefuls!

I am a 57yo engineer, hoping to pull the trigger very soon. Like others, I'd like to wait until covid and the covid economy plays out before I do so. The BS pail is full, and the tolerance pail is rather empty at w*rk. I REALLY need to get out from behind the desk, and get outside...

My details: I have been the saver/planner in our family. My 55yo DW is the spender. Somehow over the last few decades, we've struck a balance and have been lucky enough to reach some significant milestones. Staying healthy has been at the top of that list. Accumulation of a nest egg also seemed to happen over the years, I had doubts whether I could ever get there. I thought I'd join this forum after lurking for a while and both get some nagging questions answered by others while maybe giving some back to aspiring early savers that might be needing encouragement. I've learned some stuff over this long journey.

My financial details:

The bad: No pensions, no real estate investments outside of our home.

The good:

Our pre-medicare health care will be fairly low expense, as I will get a company-subsidized plan until we are 65. Very lucky there...

My DW will continue contract work for several years, helping to ensure making sure our two boys make it out of college. (most all of this is already accounted for thankfully) SS will assist when the time comes.

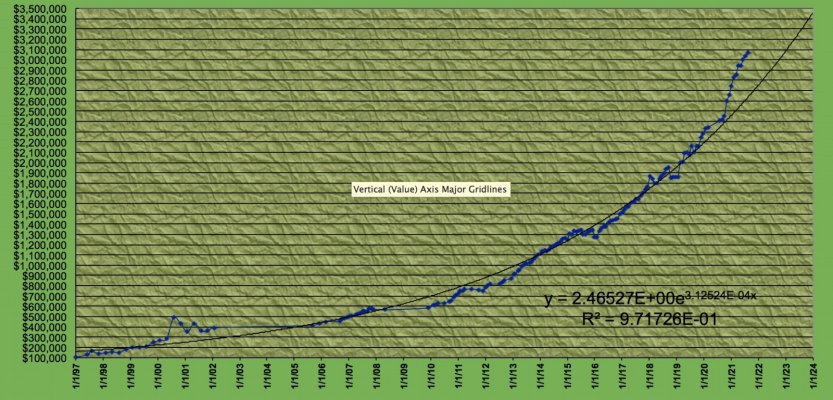

In my thirties, I was seriously nervous that I would never have a big nest egg. As some encouragement to the more younger FIRE hopefuls, I offer my investment curve here, covering the last 25 years. The flat spots are those times when I couldn't bear looking at it. At 33, I had <$100K NW. I saved, it grew, and compounding made it grow fast. After every raise, I increased saving, putting most bonuses back into my egg. It happens...trust me.

Anyhoo, thanks to the many posters here, and I look forward to more conversations from you good people.

I am a 57yo engineer, hoping to pull the trigger very soon. Like others, I'd like to wait until covid and the covid economy plays out before I do so. The BS pail is full, and the tolerance pail is rather empty at w*rk. I REALLY need to get out from behind the desk, and get outside...

My details: I have been the saver/planner in our family. My 55yo DW is the spender. Somehow over the last few decades, we've struck a balance and have been lucky enough to reach some significant milestones. Staying healthy has been at the top of that list. Accumulation of a nest egg also seemed to happen over the years, I had doubts whether I could ever get there. I thought I'd join this forum after lurking for a while and both get some nagging questions answered by others while maybe giving some back to aspiring early savers that might be needing encouragement. I've learned some stuff over this long journey.

My financial details:

The bad: No pensions, no real estate investments outside of our home.

The good:

- Just hit $2.5M invested, $3.0M net worth (My targets)

- No debt outside of a winding down car payment, free and clear on the house.

- 70% stocks, 25% bonds, and 5% cash

- $1.7M in deferred 401Ks, $415K after-tax, long- term capital gain eligible, $390K in tax free ROTHs, HSAs, or cash

Our pre-medicare health care will be fairly low expense, as I will get a company-subsidized plan until we are 65. Very lucky there...

My DW will continue contract work for several years, helping to ensure making sure our two boys make it out of college. (most all of this is already accounted for thankfully) SS will assist when the time comes.

In my thirties, I was seriously nervous that I would never have a big nest egg. As some encouragement to the more younger FIRE hopefuls, I offer my investment curve here, covering the last 25 years. The flat spots are those times when I couldn't bear looking at it. At 33, I had <$100K NW. I saved, it grew, and compounding made it grow fast. After every raise, I increased saving, putting most bonuses back into my egg. It happens...trust me.

Anyhoo, thanks to the many posters here, and I look forward to more conversations from you good people.