Philliefan33

Thinks s/he gets paid by the post

- Joined

- Oct 20, 2014

- Messages

- 1,677

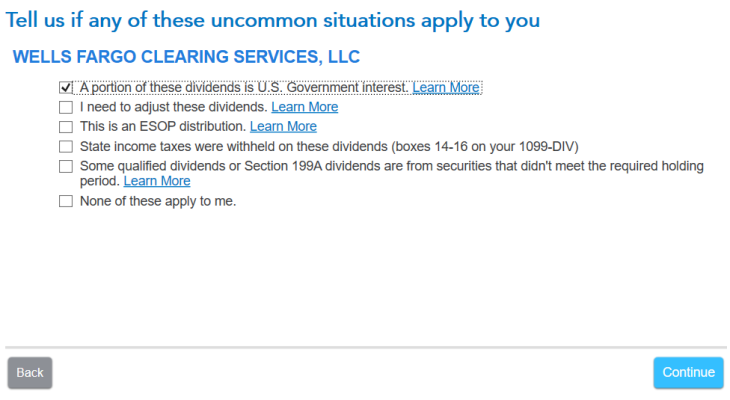

Because of the training I’ve received as an AARP Tax Aide, I know to look for it. But most of the time the effect is negligible for the funds I hold. For example, $2000 worth of dividends that is 3% non-taxable in PA reduces my state tax bill by $2. Hardly worth doing, except for the practice.