Digger1000

Recycles dryer sheets

- Joined

- May 10, 2017

- Messages

- 121

I retired 3.4 years ago at age 51 on April 3,2017 and am 99% in stock mutual funds. If this is the wrong forum move it, I thought those retired would be the biggest help.

Long post ahead.

I guess my 2 questions will mainly involve:

1. Taxes

2. Bonds. I know nothing about bonds.

On the taxes part, I have a question on long term capital gains loss carryover and capital gains. I currently have an $80,000 long term capital gains loss that I get to deduct $3,000 every year(been doing so since 2000). I have never had to sell any shares yet(I lived on dividends and a small cash amount I had when I retired) so I have a question, if say for example I sell something that has a $20,000 capital gain would I then deduct that from the 80k and then have 60k to carry over the next year? I would pay $0 taxes on the 20k capital gains that I sold in that year? I actually sold a few thousand dollars of capital gains in the past 2 months so I have never had to report capital gains yet on a tax return yet.

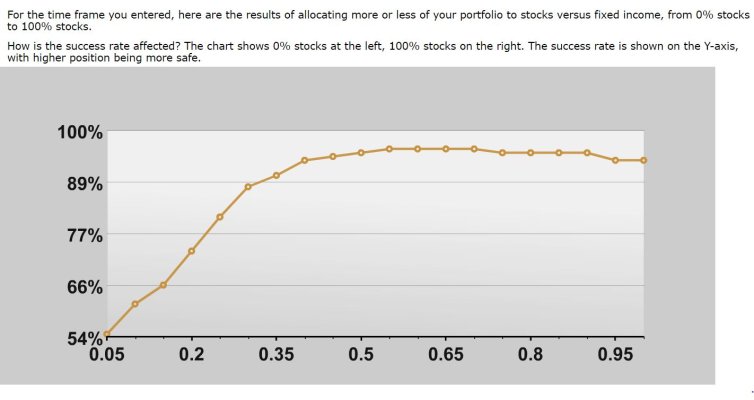

I always thought I would remain 100%(98% or more) in stocks even in retirement. I had thought I would work till 65 as I loved my work. But the politics and people made for such a toxic environment that it was impossible for me to even consider continuing to work. 4 months before I quit I did some research for the 1st time on early retirement and ACA. I saw how doable it was for me to FIRE. Things got better for a short time at work so I waited for 4 months to retire when things took a worse than ever turn at work. I pulled the plug and I have been happier and happier each and everyday that I did so. Things have been easier than I thought they would be and I thought things would go well but not this well.

I am a bachelor. I dont have a lot of money like some people on here do. I still am under a million. I am very frugal. I have always had the philosophy of invest aggressively and live very,very conservatively. So far in retirement the most I spent of my original retirement amount was 2.6% in year 1 when I moved out of state. The 2nd year was 2.1%. Year 3 was 2.5% as I had a very unexpected hernia surgery. I drove 365 miles to have it done more inexpensively as I have an 8k deductible and $0 premium ACA health insurance. I paid for the surgery with my debit card.

What has made me start to think seriously about moving out of the stock market was my call to SS at the beginning of Feb. With $0 dollars earned for every year going forward my benefit at 62 would be the same amount I lived on in year 2 of my retirement. At age 70 the amount of SS alone would be very comfortable for me to live on. More than I am spending now. I was shocked. Once again that is with $0 earned in every year going forward. I have always planned on taking SS at age 70.

I'm up 41% net worth since retirement. I currently live on 1.6% of my current net worth. Thats why getting out could be attractive to me. I have always lived with the preparedness of the market tumbling 50-66%. So I have always lived bare bones. But if I could get out and find something with a 3% return I could live a little more comfortably. I have always approached stocks as putting all your chips in the middle of the table and willing to lose everything. Its happened to me before. In 2000. Went from 276k to 15k.

Since 2000 I have been 98% S&P 500 and 1% semiconducters. Going down over 30% earlier this year didnt faze me or worry me. Didnt change my life 1 iota. I get worried when things are going well. In times like January I always pull up old articles on the worst bear markets in history to prepare myself for whats ahead and realize that I have half as much money as I think I have. Its all on paper.

I have been in the stock market since 1992. But I know nothing about bonds or how they work. What is most confusing is they talk about rates being low and how that is bad for bonds but dont they mean treasuries? Are low rates good or bad for bonds?

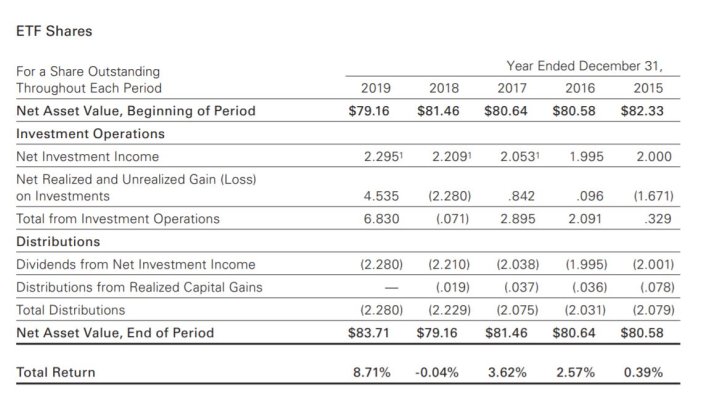

Is the Vanguard Total Bond Index the way to go? They show the past results are 3.84% the last 10 years and 4.5% since Nov 2001.

Is 3% average return a realistic expectation going forward for bonds? Are there better bond funds than vbtlx? I see other vanguard bond funds with better returns over the past 10 years.

So how do dividends work? Is it monthly from looking at vbtlx online? I'm use to quarterly with S&P 500. How much is that dividend in vbtlx? Is it a little over 2 cents per share each month from reading it? Sorry I'm so dense.

Currently I have:

23.67% 403b/ira

16.6% roth ira

58.6% taxable

1% cash

Obviously I can take the 403b/ira portion out of the market no problem. I would expect I would want to leave the roth ira in the market. I currently convert $15,400 annually and I still pay $0 federal taxes. Also $0 in state taxes in Ohio since they dont tax poor people like me .

.

My type personality is all or nothing. If I were to make the decision to get out of the market I would prefer to get out completely. That of course is not possible when taking taxes into consideration. Its important to make sure I understand my longterm capital gains loss carryover when I sell taxable shares going forward. If I'm understanding my long term capital gains loss correctly I believe I could sell enough to get to 37% bonds pretty comfortably including the ira portion. I could get to 40% bonds if I pushed it to the edge of my long term loss. But I have always used the loss to add another $3000 dollars to my roth conversion every year. Plus my LT loss can continue to give my $0 gain when I start having to sell to live on going forward as the state would tax me some if I eventually have to have actual capital gains(remember I had my 1st sell this summer). Eventually I want to move to Tennessee. No state taxes period. I want to live in East Tennessee anyway. Snake fears have kept me from doing so thus far. Also I am going to keep things where I pay $0 health insurance premiums. That will not be a problem for years if ACA keeps going.

Another question. So for federal taxes you can have $51,000 in capital gains and dividends without paying taxes right? Thats as a single $12,400 deductible in 2020. Thats a question for years down the road if I'm living in a no tax state and trying to keep moving money out of the market.

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Is the bond return in this link the same as the vtblx? Or is there a different bond fund that it is comparable too?

Please give me recommendations for bond funds. And what the expectations,etc of investing in bonds/bond funds might be. Or any other investment ideas outside of bonds if you think they would be better.

Sorry for the terrible rambling. It was even harder than I thought. I probably forgot some questions too.

Long post ahead.

I guess my 2 questions will mainly involve:

1. Taxes

2. Bonds. I know nothing about bonds.

On the taxes part, I have a question on long term capital gains loss carryover and capital gains. I currently have an $80,000 long term capital gains loss that I get to deduct $3,000 every year(been doing so since 2000). I have never had to sell any shares yet(I lived on dividends and a small cash amount I had when I retired) so I have a question, if say for example I sell something that has a $20,000 capital gain would I then deduct that from the 80k and then have 60k to carry over the next year? I would pay $0 taxes on the 20k capital gains that I sold in that year? I actually sold a few thousand dollars of capital gains in the past 2 months so I have never had to report capital gains yet on a tax return yet.

I always thought I would remain 100%(98% or more) in stocks even in retirement. I had thought I would work till 65 as I loved my work. But the politics and people made for such a toxic environment that it was impossible for me to even consider continuing to work. 4 months before I quit I did some research for the 1st time on early retirement and ACA. I saw how doable it was for me to FIRE. Things got better for a short time at work so I waited for 4 months to retire when things took a worse than ever turn at work. I pulled the plug and I have been happier and happier each and everyday that I did so. Things have been easier than I thought they would be and I thought things would go well but not this well.

I am a bachelor. I dont have a lot of money like some people on here do. I still am under a million. I am very frugal. I have always had the philosophy of invest aggressively and live very,very conservatively. So far in retirement the most I spent of my original retirement amount was 2.6% in year 1 when I moved out of state. The 2nd year was 2.1%. Year 3 was 2.5% as I had a very unexpected hernia surgery. I drove 365 miles to have it done more inexpensively as I have an 8k deductible and $0 premium ACA health insurance. I paid for the surgery with my debit card.

What has made me start to think seriously about moving out of the stock market was my call to SS at the beginning of Feb. With $0 dollars earned for every year going forward my benefit at 62 would be the same amount I lived on in year 2 of my retirement. At age 70 the amount of SS alone would be very comfortable for me to live on. More than I am spending now. I was shocked. Once again that is with $0 earned in every year going forward. I have always planned on taking SS at age 70.

I'm up 41% net worth since retirement. I currently live on 1.6% of my current net worth. Thats why getting out could be attractive to me. I have always lived with the preparedness of the market tumbling 50-66%. So I have always lived bare bones. But if I could get out and find something with a 3% return I could live a little more comfortably. I have always approached stocks as putting all your chips in the middle of the table and willing to lose everything. Its happened to me before. In 2000. Went from 276k to 15k.

Since 2000 I have been 98% S&P 500 and 1% semiconducters. Going down over 30% earlier this year didnt faze me or worry me. Didnt change my life 1 iota. I get worried when things are going well. In times like January I always pull up old articles on the worst bear markets in history to prepare myself for whats ahead and realize that I have half as much money as I think I have. Its all on paper.

I have been in the stock market since 1992. But I know nothing about bonds or how they work. What is most confusing is they talk about rates being low and how that is bad for bonds but dont they mean treasuries? Are low rates good or bad for bonds?

Is the Vanguard Total Bond Index the way to go? They show the past results are 3.84% the last 10 years and 4.5% since Nov 2001.

Is 3% average return a realistic expectation going forward for bonds? Are there better bond funds than vbtlx? I see other vanguard bond funds with better returns over the past 10 years.

So how do dividends work? Is it monthly from looking at vbtlx online? I'm use to quarterly with S&P 500. How much is that dividend in vbtlx? Is it a little over 2 cents per share each month from reading it? Sorry I'm so dense.

Currently I have:

23.67% 403b/ira

16.6% roth ira

58.6% taxable

1% cash

Obviously I can take the 403b/ira portion out of the market no problem. I would expect I would want to leave the roth ira in the market. I currently convert $15,400 annually and I still pay $0 federal taxes. Also $0 in state taxes in Ohio since they dont tax poor people like me

My type personality is all or nothing. If I were to make the decision to get out of the market I would prefer to get out completely. That of course is not possible when taking taxes into consideration. Its important to make sure I understand my longterm capital gains loss carryover when I sell taxable shares going forward. If I'm understanding my long term capital gains loss correctly I believe I could sell enough to get to 37% bonds pretty comfortably including the ira portion. I could get to 40% bonds if I pushed it to the edge of my long term loss. But I have always used the loss to add another $3000 dollars to my roth conversion every year. Plus my LT loss can continue to give my $0 gain when I start having to sell to live on going forward as the state would tax me some if I eventually have to have actual capital gains(remember I had my 1st sell this summer). Eventually I want to move to Tennessee. No state taxes period. I want to live in East Tennessee anyway. Snake fears have kept me from doing so thus far. Also I am going to keep things where I pay $0 health insurance premiums. That will not be a problem for years if ACA keeps going.

Another question. So for federal taxes you can have $51,000 in capital gains and dividends without paying taxes right? Thats as a single $12,400 deductible in 2020. Thats a question for years down the road if I'm living in a no tax state and trying to keep moving money out of the market.

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

Is the bond return in this link the same as the vtblx? Or is there a different bond fund that it is comparable too?

Please give me recommendations for bond funds. And what the expectations,etc of investing in bonds/bond funds might be. Or any other investment ideas outside of bonds if you think they would be better.

Sorry for the terrible rambling. It was even harder than I thought. I probably forgot some questions too.