You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I received my IRMAA increase, Arrgh!

- Thread starter Time2

- Start date

Retire2023

Recycles dryer sheets

- Joined

- Mar 10, 2019

- Messages

- 98

I believe that you pay your drug plan premium, and you will also pay Medicare the IRMAA tier surcharge. It increases the cost of your prescription coverage, but you have to "make 2 payments" for that same coverage each month. No additional coverage by Medicare for prescriptions.

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,143

I appreciate the input! This IRMAA year is something I never expected to be exposed to. As I said we are comfortable with spending about $70k a year. However, I have been withdrawing a little more for Roth Conversions. I had been taking a lump sum withdrawal in December after doing income calculations figured to stay under the next tax bracket.

This had worked well for 3 years until 2022 when I made double withdrawal error and end up having Champagne and Caviar with IRMAA.

I still don't know what the $53.80 covers.

With medicare on my statements I see Medicares covers, say an x-ray at a certain amount, then my Medigap plan covers the rest. With drugs on my Humana statement all I see is Humana paid $x.00 and I pay the rest, there is no payment from Medicare.

So where does the $53.80 come from?

Thanks

Medicare does not cover most ordinary prescription medicine. Here is an explanation of what drugs are covered by Medicare https://www.medicare.gov/coverage/prescription-drugs-outpatient. Unless your drugs are included in this list, you won't see where Medicare pays for drugs, because they don't. Your ordinary prescription medicines are covered either by a part D plan or a Medicare Advantage plan. Or it's possible you have some sort of subsidized coverage through a former employer. You must have one or the other or they would not be assessing you an IRMAA premium for Part D. You can read more about it here https://q1medicare.com/faq/FAQ.php?faq=am-i-assessed-part-d-irmaa-if-not-in-drug-plan&faq_id=680#:~:text=No.,through%20the%20VA%20or%20Tricare).

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,402

With drugs on my Humana statement all I see is Humana paid $x.00 and I pay the rest, there is no payment from Medicare.

So where does the $53.80 come from?

Thanks

Is it possible your drug costs were all under the deductible for the year? I think the deductible was $485 in 2023. I'm on only one prescription and the first refill of the year I pay the sticker price but after that I'm through the deductible and my Plan D pays something like 60%. The Medicare web site lets you compare the annual out-of-pocket costs of your prescriptions under various plans if you input your prescriptions.

stedmakr

Dryer sheet aficionado

For Time2 - two points

Medicare is heavily subsidized by the federal government. Medicare is also means tested. Some low income people don't pay anything for Medicare, other low income people don't have to pay their part B premium. Most people pay a standard premium for Part B. This year it is $164.90. If an individual or couple (depends how you file your taxes) makes above a certain level of income you pay a SURCHARGE which is called IRMAA. There is an IRMAA determination every year based on your income from two years before.

Part D enrollment is also means tested and subject to the IRMAA surcharge. Same logic as above. If your income from two years ago is above a certain threshold you will pay IRMAA for Part D. What does it pay for? Theoretically it makes Americans who have a high income pay their fare share for Medicare. (The wording in the last sentence could be better but I can't think of the right word)

Second point - APPEAL

There are seven life changing events that Medicare accepts for an appeal. Making a mistake on a withdrawal(s) is not one of the seven. However an appeal only takes about an hour or two. Find and fill out the form (SSA-44) and include a compelling cover letter and mail it to your local SSA office. If the office is close walk in or make an appointment with the form and cover letter.

Your cover letter tells your story. Clearly state what happened in 2022 and what you estimated income will be in 2024.

As a volunteer I have helped several people with appeals. All were successful because they experienced one of the seven life changing events. My wife processed an appeal for a couple who sold their business two years previous and found themselves in the highest IRMAA bracket. This situation was not one of the seven life changing events but the SSA approved the appeal. It did have a strong cover letter. I believe this indicated that the SSA office either made a mistake or they have a level of discretion when they make appeal decisions.

The Youtube video at the following URL provides an excellent explanation and how to process for an IRMAA appeal.

Medicare is heavily subsidized by the federal government. Medicare is also means tested. Some low income people don't pay anything for Medicare, other low income people don't have to pay their part B premium. Most people pay a standard premium for Part B. This year it is $164.90. If an individual or couple (depends how you file your taxes) makes above a certain level of income you pay a SURCHARGE which is called IRMAA. There is an IRMAA determination every year based on your income from two years before.

Part D enrollment is also means tested and subject to the IRMAA surcharge. Same logic as above. If your income from two years ago is above a certain threshold you will pay IRMAA for Part D. What does it pay for? Theoretically it makes Americans who have a high income pay their fare share for Medicare. (The wording in the last sentence could be better but I can't think of the right word)

Second point - APPEAL

There are seven life changing events that Medicare accepts for an appeal. Making a mistake on a withdrawal(s) is not one of the seven. However an appeal only takes about an hour or two. Find and fill out the form (SSA-44) and include a compelling cover letter and mail it to your local SSA office. If the office is close walk in or make an appointment with the form and cover letter.

Your cover letter tells your story. Clearly state what happened in 2022 and what you estimated income will be in 2024.

As a volunteer I have helped several people with appeals. All were successful because they experienced one of the seven life changing events. My wife processed an appeal for a couple who sold their business two years previous and found themselves in the highest IRMAA bracket. This situation was not one of the seven life changing events but the SSA approved the appeal. It did have a strong cover letter. I believe this indicated that the SSA office either made a mistake or they have a level of discretion when they make appeal decisions.

The Youtube video at the following URL provides an excellent explanation and how to process for an IRMAA appeal.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That brings up a question I never thought of.I'm looking over my Humana Drug plan and I don't see where medicare covers any of the drugs I take.

I can only suspect that the $53.80 I'm being charged is for, in hospital drugs. But I'm listening for anyone that knows.

Do those who haven’t opted for a Part D plan have to pay the IRMAA Part D penalty too? We have a Part D plan with WellCare so I never thought about it.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

No, I don’t believe you pay Part D IRMAA if you don’t have a Part D plan.

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,143

No, I don’t believe you pay Part D IRMAA if you don’t have a Part D plan.

Not entirely true. If you have Medicare Advantage that contains drug coverage you pay IRMAA. If you have some sort of subsidized coverage through a former employer/union you pay IRMAA. It's not just those on separate Part D. https://q1medicare.com/faq/FAQ.php?faq=am-i-assessed-part-d-irmaa-if-not-in-drug-plan&faq_id=680#:~:text=No.,through%20the%20VA%20or%20Tricare).

Sorry folks, I think I have a fundamental misunderstanding.

I still don't know if I have Medicare Part D, I know I have a supplemental policy Part D from Humana.

Does regular Medicare paid to CMS Medicare Insurance, include Medicare Part D coverage?

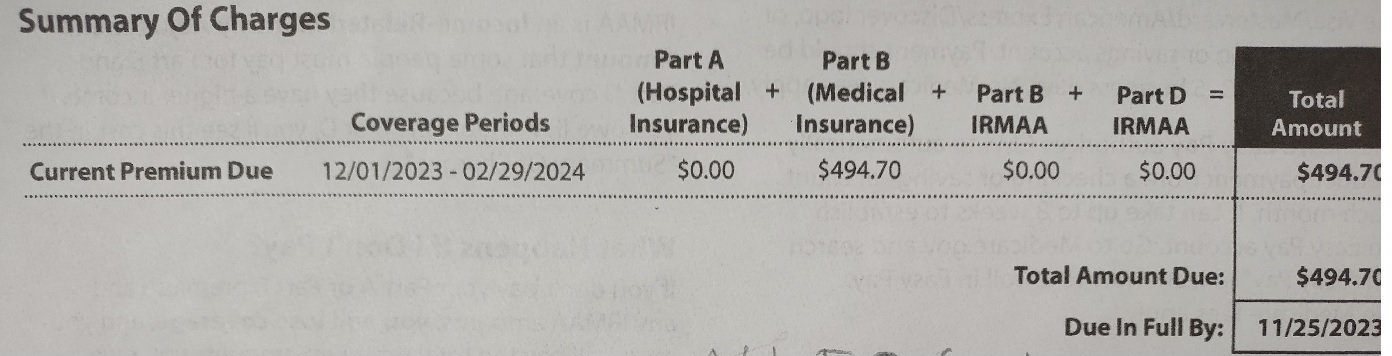

Below is a photo of my Medicare Premium Bill Summary of Charges.

No Charge for Part A, $494.70 charge for Part B, No Part B IRMAA charge, and No Part D IRMAA charge.

Does that mean I don't have Medicare Part D coverage?

Or is there no charge for Medicare Part D until you hit IRMAA?

I still don't know if I have Medicare Part D, I know I have a supplemental policy Part D from Humana.

Does regular Medicare paid to CMS Medicare Insurance, include Medicare Part D coverage?

Below is a photo of my Medicare Premium Bill Summary of Charges.

No Charge for Part A, $494.70 charge for Part B, No Part B IRMAA charge, and No Part D IRMAA charge.

Does that mean I don't have Medicare Part D coverage?

Or is there no charge for Medicare Part D until you hit IRMAA?

Attachments

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

That Humana policy is your Medicare Part D coverage. So you do have coverage.Sorry folks, I think I have a fundamental misunderstanding.

I still don't know if I have Medicare Part D, I know I have a supplemental policy Part D from Humana.

Does regular Medicare paid to CMS Medicare Insurance, include Medicare Part D coverage?

Below is a photo of my Medicare Premium Bill Summary of Charges.

No Charge for Part A, $494.70 charge for Part B, No Part B IRMAA charge, and No Part D IRMAA charge.

Does that mean I don't have Medicare Part D coverage?

Or is there no charge for Medicare Part D until you hit IRMAA?

You don’t pay anything to Medicare for Part D unless you are subject to IRMAA. And in that case the Part D IRMAA is paid to CMS Medicare, not the Part D policy provider.

Last edited:

Masquernom

Full time employment: Posting here.

Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare provided through private plans that contract with the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan (PDP) to supplement traditional Medicare or a Medicare Advantage plan, mainly HMOs and PPOs, that provides all Medicare-covered benefits, including prescription drugs (MA-PD).

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not entirely true. If you have Medicare Advantage that contains drug coverage you pay IRMAA. If you have some sort of subsidized coverage through a former employer/union you pay IRMAA. It's not just those on separate Part D. https://q1medicare.com/faq/FAQ.php?faq=am-i-assessed-part-d-irmaa-if-not-in-drug-plan&faq_id=680#:~:text=No.,through%20the%20VA%20or%20Tricare).

OK thanks.

stedmakr

Dryer sheet aficionado

Your graphic shows three months of coverage. If you are new to medicare and not taking social security benefits your initial invoice will be for three months.

Since you don't know what insurance you have, call Medicare 1-800-633-4227 and ask. They will tell you what insurance you have and also answer your other questions.

Since you don't know what insurance you have, call Medicare 1-800-633-4227 and ask. They will tell you what insurance you have and also answer your other questions.

That Humana policy is your Medicare Part D coverage. So you do have coverage.

Yes, that part is clear, Humana has at least partially covered my prescriptions.

That was not made clear, I have not even found any record or link saying, 'your Medicare premium includes Part D drug coverage' However, I do see that Medicare part D does cover certain drugs, that is important to me as I have an underlying condition.You don’t pay anything to Medicare for Part D,

Yes, I see a line for Part D IRMAA Charge where it will be included, SOON.unless you are subject to IRMAA. And in that case the Part D IRMAA is paid to CMS Medicare, not the Part D policy provider.

I think I understand now, it is as simple as Medicare Part D coverage comes automatically with Medicare Part D coverage. And If you are subject to IRMAA, you will also get an IRMAA Part D Upcharge.

Your graphic shows three months of coverage. If you are new to medicare and not taking social security benefits your initial invoice will be for three months.

Not new, have been on it for almost 4 years. I understand payments are made quarterly.

Since you don't know what insurance you have, call Medicare 1-800-633-4227 and ask. They will tell you what insurance you have and also answer your other questions.

I'm sorry, I signed up for Medicare, I have no knowledge there is more than one type of Medicare plan available through CMS. Do you?

harllee

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The OP is paying less than $500 per month for Medicare, which is in my opinion great health insurance and is bargain at $500 per month. I am subject IRMMA also and gladly pay it for the benefit I get from Medicare. Those of us subject to IRMMA are very fortunate to have such large incomes.

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,143

I think the confusion may stem from the use of "Medicare Part D". It's not Medicare that covers the Part D drugs. It is private insurance companies like Humana, Aetna, United Health Care, etc. Not Medicare. Does this help explain things to you?

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

While I could not find it at medicare.gov, I found this for anyone who is NOT enrolled in a Part D plan. If you’re being charged, you should win on appeal.That brings up a question I never thought of.

Do those who haven’t opted for a Part D plan have to pay the IRMAA Part D penalty too? We have a Part D plan with WellCare so I never thought about it.

No. You should not pay an Income-Related Monthly Adjustment Amount (IRMAA) for Medicare Part D if you are not enrolled in a Medicare Part D drug plan (for example, you have no drug coverage or you get your supplemental drug coverage through the VA or Tricare).

As noted by the Centers for Medicare and Medicaid Services (CMS):

"If an individual does not have or no longer has Medicare prescription drug coverage, they shouldn’t be charged the Part D-IRMAA."

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,143

While I could not find it at medicare.gov, I found this for anyone who is NOT enrolled in a Part D plan. If you’re being charged, you should win on appeal.

If you will read this link https://q1medicare.com/faq/FAQ.php?faq=am-i-assessed-part-d-irmaa-if-not-in-drug-plan&faq_id=680#:~:text=No.,through%20the%20VA%20or%20Tricare). you will see this explained

"Question: But, I do not have a Medicare drug plan so why am I still paying Part D IRMAA?

You actually have Medicare Part D drug coverage in another form.

Quite often people are assessed Part D IRMAA because they are actually enrolled in some form of “supplemental” prescription drug policy that is equivalent to a Medicare Part D plan.

For example, if you are enrolled in a prescription drug plan through a Medicare Advantage plan (MAPD) - or an employer health or drug plan - or union health plan - or retiree healthcare coverage - you will need to pay Part D IRMAA."

Time2, you can take the year before tax return to your local SS office. Show them that you accidentally took two withdrawals. Explain you won't do that next year. Fill out the form and they should leave you at the previous year's income level.

The year I started Medicare, I had sold some property the previous year and my wife worked most of the year. She retired and the property sale was a one time thing. I explained it to the SS office and they adjusted my IRMAA, no problem.

I'm not hopeful that would have success. That is the income I had for that year, I think $336k. Looking through the reasons for a dispute none of them use any income averaging. The reasons for a dispute are below. The only one, if very broadly applied and we called Mutual funds property (Loss of income from income producing property) I could say I lost income, Because I didn't take it!

I don't see that flying.

Does anyone else see that as possible?

Tax return inaccurate or out of date

- A beneficiary filed an amended tax return for the year SSA is using to make an IRMAA decision

- There was an error in the IRS data

- The IRS provided SSA with older data and the beneficiary wants to use newer information

- You had a major life-changing event that significantly reduced your income

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

https://www.hhs.gov/about/agencies/omha/the-appeals-process/part-b-premium-appeals/index.html

I think the confusion may stem from the use of "Medicare Part D". It's not Medicare that covers the Part D drugs. It is private insurance companies like Humana, Aetna, United Health Care, etc. Not Medicare. Does this help explain things to you?

Maybe my confusion is that the Part D policies bought from For Profit Companies are called 'MEDICARE Part D'. When the are not paid by MEDICARE, they are regulated by MEDICARE, but as far as I know, they are not subsidized by MEDICARE. Is this correct?

Does not help, because I see drugs that are covered under Medicare.

"Medicare Part B (Medical Insurance) includes limited drug coverage.

It doesn’t cover most drugs you get at the pharmacy."

The quote is from Part 2 of,

https://www.medicare.gov/publications/11109-Medicare-Drug-Coverage-Guide.pdf

OK, Maybe, I look at what drugs are covered under CMS Medicare and find it says the drugs are covered under Medicare Part B.

Are the Supplemental Drug plans subsidized my Medicare? And that's why IRMMA?

Or Does IRMAA just help pay for those (limited) drugs that CMS Medicare covers.

Yes I do have a supplemental Humana Part D Plan.

Last edited:

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,143

See comments in red

Maybe my confusion is that the Part D policies bought from For Profit Companies are called 'MEDICARE Part D'. When the are not paid by MEDICARE, they are regulated by MEDICARE, but as far as I know, they are not subsidized by MEDICARE. Is this correct?

Unlike Parts A and B, which are administered by Medicare itself, Part D is provided through private plans.[3] That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts.[4] In order to have Part D coverage, beneficiaries must purchase a policy (i.e., enroll in a plan) offered by one of these companies.

Does not help, because I see drugs that are covered under Medicare.

"Medicare Part B (Medical Insurance) includes limited drug coverage.

It doesn’t cover most drugs you get at the pharmacy."

The quote is from Part 2 of,

https://www.medicare.gov/publications/11109-Medicare-Drug-Coverage-Guide.pdf

See this link

https://cmsnationaltrainingprogram.cms.gov/sites/default/files/shared/11315-P%20Drug-Coverage-Parts-Medicare.pdf

OK, Maybe, I look at what drugs are covered under CMS Medicare and find it says the drugs are covered under Medicare Part B. See above link

Are the Supplemental Drug plans subsidized my Medicare? And that's why IRMMA? Yes

Or Does IRMAA just help pay for those (limited) drugs that CMS Medicare covers. No

Yes I do have a supplemental Humana Part D Plan.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I was trying to find it on the medicare.gov site directly. This is just another non-Medicare source, but thanks.If you will read this link https://q1medicare.com/faq/FAQ.php?faq=am-i-assessed-part-d-irmaa-if-not-in-drug-plan&faq_id=680#:~:text=No.,through%20the%20VA%20or%20Tricare). you will see this explained

"Question: But, I do not have a Medicare drug plan so why am I still paying Part D IRMAA?

You actually have Medicare Part D drug coverage in another form.

Quite often people are assessed Part D IRMAA because they are actually enrolled in some form of “supplemental” prescription drug policy that is equivalent to a Medicare Part D plan.

For example, if you are enrolled in a prescription drug plan through a Medicare Advantage plan (MAPD) - or an employer health or drug plan - or union health plan - or retiree healthcare coverage - you will need to pay Part D IRMAA."

Similar threads

- Replies

- 16

- Views

- 8K