PlayinwithFIRE

Recycles dryer sheets

- Joined

- Oct 9, 2022

- Messages

- 59

Hi All -

Recent events in my life have made me wonder about benefits/detriments of having a reportable income before retirement.

I went thru a layoff recently and am wondering what options I have for optimizing .

A bit of background. I'm 54, could get another job...but man looking at job descriptions is really disheartening. None of it excites. I keep wondering if I'm simply "done" with my profession. I'm a STEM PHD..so lots of options, but the only reason to go FT is health insurance for the family. Mostly that's the kid in college and the kid in high school-we put away $ to cover college tuition ..so that part is a non-issue.

So- the leading question :

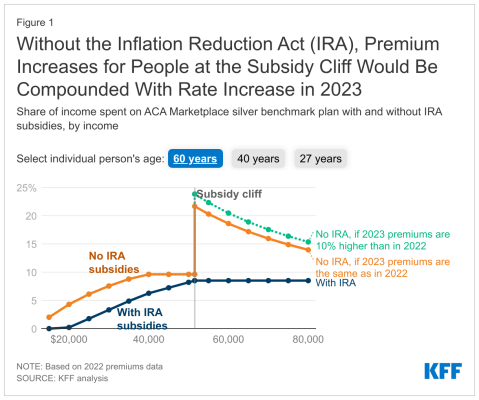

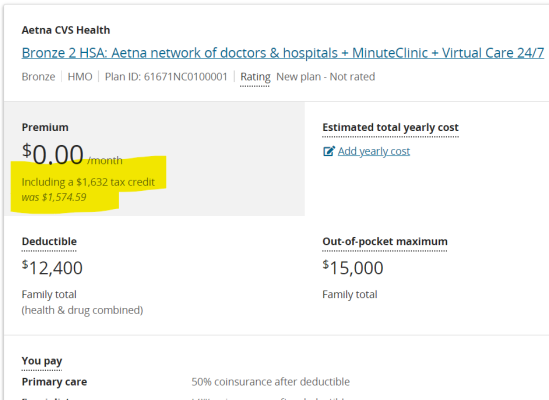

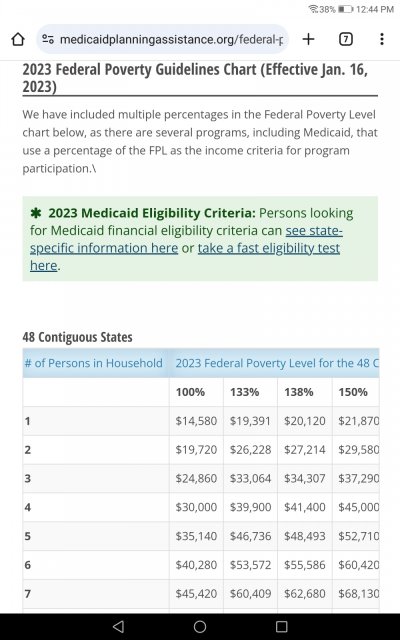

A) To get subsidies on ACA, it seems you have to be under a certain income level. What is that actual # ? Is that in the year you use the ACA or do you need to show previous year income to enjoy subsidies?

B) College - we will have a new college app in the next year or two...how is my income taken into account as far as scholarships are concerned (not loans) ? The idea would be to enhance the possibility of getting scholarships , thus leaving the money already put away to grow.

C) I did look at ACA and silver plans for my area for a family of 4 seem to run about $2000-$2500 with my current year income...i guess i should go back and put in some other income values and see what happens.

D) Social security calculation - will having "no income" or much lower than recent years potentially lower my Social Security in these years leading up to retirement (say at 62)?

I know the answer is "get back to work!" but I just ain't feeling it !

Your thoughts are appreciated,

PWF

Recent events in my life have made me wonder about benefits/detriments of having a reportable income before retirement.

I went thru a layoff recently and am wondering what options I have for optimizing .

A bit of background. I'm 54, could get another job...but man looking at job descriptions is really disheartening. None of it excites. I keep wondering if I'm simply "done" with my profession. I'm a STEM PHD..so lots of options, but the only reason to go FT is health insurance for the family. Mostly that's the kid in college and the kid in high school-we put away $ to cover college tuition ..so that part is a non-issue.

So- the leading question :

A) To get subsidies on ACA, it seems you have to be under a certain income level. What is that actual # ? Is that in the year you use the ACA or do you need to show previous year income to enjoy subsidies?

B) College - we will have a new college app in the next year or two...how is my income taken into account as far as scholarships are concerned (not loans) ? The idea would be to enhance the possibility of getting scholarships , thus leaving the money already put away to grow.

C) I did look at ACA and silver plans for my area for a family of 4 seem to run about $2000-$2500 with my current year income...i guess i should go back and put in some other income values and see what happens.

D) Social security calculation - will having "no income" or much lower than recent years potentially lower my Social Security in these years leading up to retirement (say at 62)?

I know the answer is "get back to work!" but I just ain't feeling it !

Your thoughts are appreciated,

PWF