audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

After years and years of folks expecting interest rates to climb, interest rates have really moved up this year, particularly this week. The 2yr treasury zoomed past 2% for the first time since 2008, the 10 yr past 2.4% and the 10 yr is awfully close to the 2.6% level that some pundits claim will hurt the equity markets.

Even though the yield curve continues to flatten, all rates have moved up except for the 30 yr bond which is holding steady.

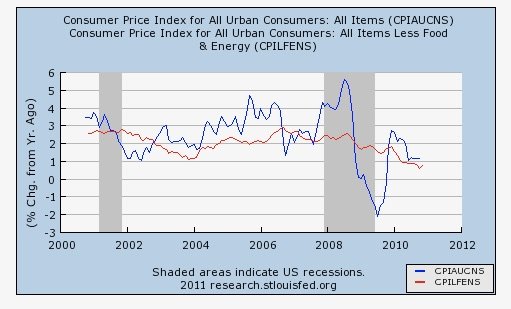

Inflation still seems to be holding at sub-2%, but other things have got the bond market a bit rattled: the continuing Fed balance sheet unwind, China indicating perhaps it would purchase less treasuries, Bloomberg indicating that repatriation of overseas assets means selling US backed bonds held overseas.

I am invested in fixed income for the long term. I figure if it gets hit hard this year I’ll have an opportunity to rebalance. Tough years are usually followed by bond market rallies. It’s just interesting to watch things unfold.

It will be really interesting to see what high yield savings accounts yield this year and what CD offers will be near the end of this year.

Even though the yield curve continues to flatten, all rates have moved up except for the 30 yr bond which is holding steady.

Inflation still seems to be holding at sub-2%, but other things have got the bond market a bit rattled: the continuing Fed balance sheet unwind, China indicating perhaps it would purchase less treasuries, Bloomberg indicating that repatriation of overseas assets means selling US backed bonds held overseas.

I am invested in fixed income for the long term. I figure if it gets hit hard this year I’ll have an opportunity to rebalance. Tough years are usually followed by bond market rallies. It’s just interesting to watch things unfold.

It will be really interesting to see what high yield savings accounts yield this year and what CD offers will be near the end of this year.

Last edited:

ESOP

ESOP  also well positioned like Danmar with my ETF hedge

also well positioned like Danmar with my ETF hedge