coltsfan53

Dryer sheet aficionado

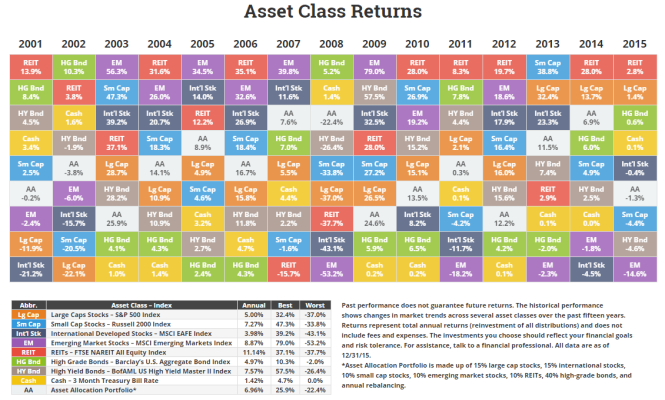

As many of you know, international index funds have massively underperformed the S&P over the past several years. Given that I keep 20% of my holdings in SCHF/OAKIX, it is disappointing to think of "what might have been" had I just plowed this same amount into VTSAX/SCHB.

Granted, the pundits say the future opportunity for the most growth is international, but given the nature of most US corporations (growing global revenues) today are these strictly international funds even a necessity anymore?

Thanks for any comments.

Granted, the pundits say the future opportunity for the most growth is international, but given the nature of most US corporations (growing global revenues) today are these strictly international funds even a necessity anymore?

Thanks for any comments.