LXEX55

Recycles dryer sheets

I would hold for at least five years. I realize no one has a crystall ball, but, experience and knowledge come into play when decision making. Thanks for reading. Opinions are welcome and appreciated.

Please don't buy it. FBGRX is a sector fund with above-average fees. That's two strikes in a game where it's one strike and you're out.... Opinions are welcome and appreciated.

This is the proven answer for investors, and a greater than five year horizon makes you an investor and not a speculator.... Own the entire market. ...

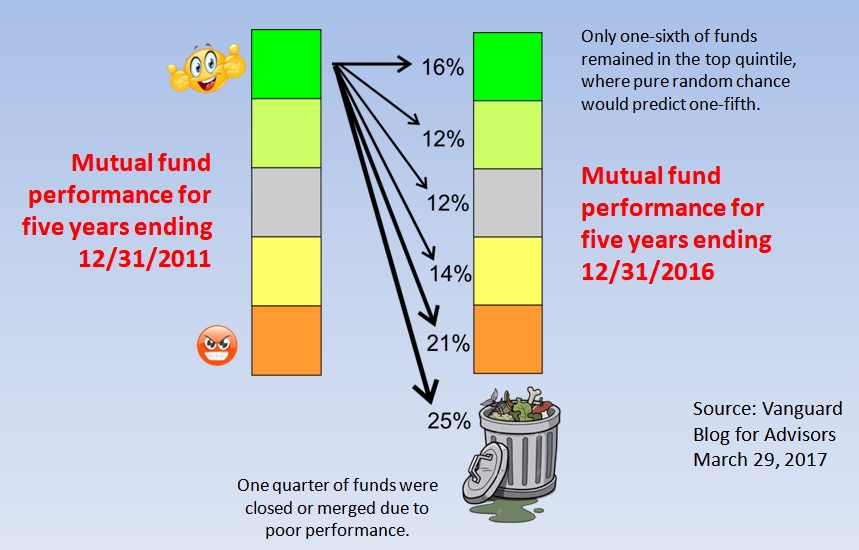

Sorry, past performance is not predictive. Below is a chart that I use with my Adult-Ed investing class. Apologies to anyone bored/if you have seen it posted before.This fund only has my love as long as it delivers results better than the alternative.

0.8% fee.

Nope.

0.36% for FNCMX and the same performance

Not the same performance. YTD 20% vs 28%, 3 mo 21% vs 26%, 1 mo 6% vs &7%.

I agree that the performance of funds will change. That is why I watch mine like a hawk.

... Oldshooter has a very strong opinion... managed fund haters ...

Not me, if you count me as a "hater." There is no such concept as "overdue" in random processes. If I flip heads five times in a row, the odds of tails on the next flip are unchanged: 50/50.... Since past performance is not future results, the managed fund haters would definitely believe its well over due to perform poorly. ...

Exactly. The poster child for this was a guy named Bill Miller at Legg Mason. He outperformed for like ten years before his luck ran out and in two years he destroyed the fund. More: https://www.reuters.com/article/us-...er-leaves-firm-amid-faded-glory-idUSKCN10M1DV... no guarantee at all it would continue to outperform.