Ok, so is there a withdrawl calculator? One that I can imput an account, it will add the estimated intrest per year, and i will set the withdrawl rate. So it will let me see how many years I can pull from an account untill it goes dry? I can and have been doing long calculations on paper but its a pita, especially over like 30 years. And then changing the withdrawl rate and starting over. Can this be done in Fire Calc? I dont need all the other stuff just curious on one account.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is there a withdrawal calculator?

- Thread starter Slim11

- Start date

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Just input the one account in any of the popular calculators with the proper allocation.

Last edited:

Is there a basic one ? Only thing I know of is the fire calc, sorry. I am technology challenged. I want to spend down my 457, early, I think. So , take distributions now while my assets are less. Roll that into a roth ( i have to see if this is possable peicemeal) , and then in 8 years pay for the kids collage. I think when I hit 60 in 10 years I will jump to the next tax bracket. So maybe its better to pay the taxes now at the 24 percent?

COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

FICalc is more robust than FireCalc. More options.

SevenUp

Full time employment: Posting here.

- Joined

- Jul 3, 2014

- Messages

- 882

In Excel, =NPER(1.5%,-40000,1000000,0) should tell you 31.6 years if you start with $1 million, withdraw $40K/yr, and are earning 1.5%/yr on the balance.One that I can imput an account, it will add the estimated intrest per year, and i will set the withdrawl rate. So it will let me see how many years I can pull from an account untill it goes dry?

See NPER function for details. Google Sheets may work similarly.

Ok, so is there a withdrawl calculator? One that I can imput an account, it will add the estimated intrest per year, and i will set the withdrawl rate. So it will let me see how many years I can pull from an account untill it goes dry? I can and have been doing long calculations on paper but its a pita, especially over like 30 years. And then changing the withdrawl rate and starting over. Can this be done in Fire Calc? I dont need all the other stuff just curious on one account.

Here is one with option for withdrawals

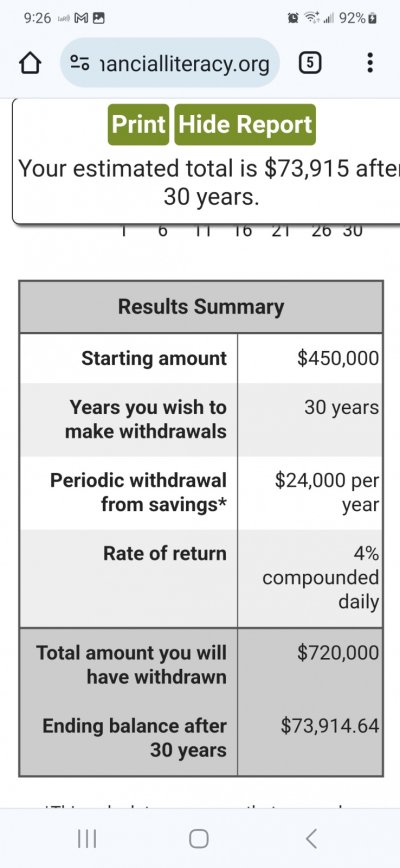

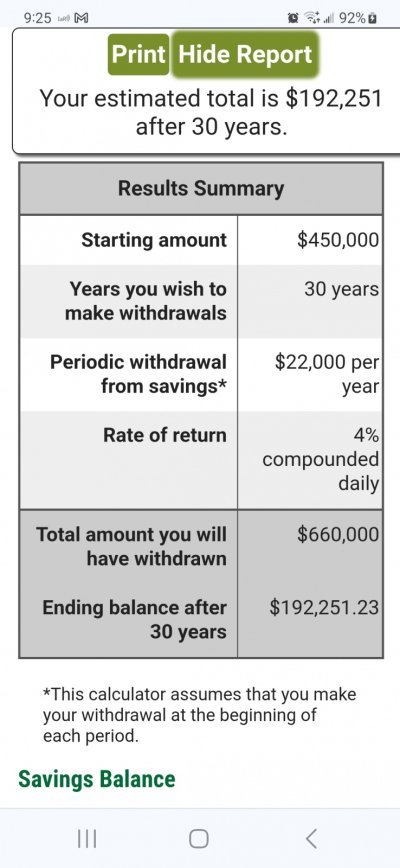

https://www.360financialliteracy.org/Calculators/Savings-Distribution-Calculator

In Excel, =NPER(1.5%,-40000,1000000,0) should tell you 31.6 years if you start with $1 million, withdraw $40K/yr, and are earning 1.5%/yr on the balance.

See NPER function for details. Google Sheets may work similarly.

Technology deficient, lol. No chance on that. But thanks.

That will be fun to fool around with. Thanks.FICalc is more robust than FireCalc. More options.

Here is one with option for withdrawals

https://www.360financialliteracy.org/Calculators/Savings-Distribution-Calculator

This was the winner quick and easy and got everything I needed! Ran 12 diffrent numbers for withdrawal through, and saw when I would empty the account, or draw it down by half or three quarters. Gives me so many more options. Ty, Ty. Now I can plan the future.

This is what I was looking for that sweet spot. What I can take while leaving a ballance. I know taxes will may be higher down the line, but its nice to know If I take 22k a year out, pay the taxes, in 30 years I will still have a fall back if I am alive. If not, some of the money will be moved to a roth, or regular account for my kido. Is it a good plan, probably not. Is it better then no plan, definitely. So I am splitting thr diffreance between tax now and tax later, will it make a diffrence for me, no. But it will when the child gets the account. Unless they change the laws......

Attachments

easiest basic withdrawal calculator I use. Just need very basic info and will show how many years your money will last.

https://www.moneyhelpcenter.com/cre...ll-money-last-systematic-withdrawals/#results

https://www.moneyhelpcenter.com/cre...ll-money-last-systematic-withdrawals/#results

Flyfish1

Recycles dryer sheets

This was the winner quick and easy and got everything I needed! Ran 12 diffrent numbers for withdrawal through, and saw when I would empty the account, or draw it down by half or three quarters. Gives me so many more options. Ty, Ty. Now I can plan the future.

Not sure if that calc takes inflation into account. The moneyhelpcenter calc allows for inflationary increases in withdrawals.

It dosen't, but I just needed numbers, not how long it will last. Just needed how much to take out each year. I dont need to drain the account, but take a little each year to stay under the next tax bracket. This , I think will make the acount more useful to me.

donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There are lots of calculators online. I was doing precisely your drill with a relative who has limited resources and a 10–15-year horizon. The key factors are the assumed rate of return and inflation (which could be a problem even over that horizon). Right now, interest rates on "safe" investments are back at a decent level, but is that the new normal? In her case, it may make sense to lock in an SPIA for part of the portfolio while rates are pretty good.

Unfortunately I am all over the place with what I want to do money wise. Lol. So , I can leave the money in the 457, and not touch it. It will be 1.1 million by the time I have to take distributions at 73, or I can start drawing it down from now at 50 years old for the next 40 years. This second option will keep me in the 24 percent tax bracket. Then I will maybe roll over the 22k per year into a roth, and pay the taxes with other money? IDK . It spunds like a load of work to avoid taxes in the future.There are lots of calculators online. I was doing precisely your drill with a relative who has limited resources and a 10–15-year horizon. The key factors are the assumed rate of return and inflation (which could be a problem even over that horizon). Right now, interest rates on "safe" investments are back at a decent level, but is that the new normal? In her case, it may make sense to lock in an SPIA for part of the portfolio while rates are pretty good.

Similar threads

- Replies

- 57

- Views

- 3K