Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

FYI, John confesses to his investment sin. And then defends his actions.

https://humbledollar.com/2022/10/my-investment-sin/

https://humbledollar.com/2022/10/my-investment-sin/

Jonathan Clements | Oct 15, 2022

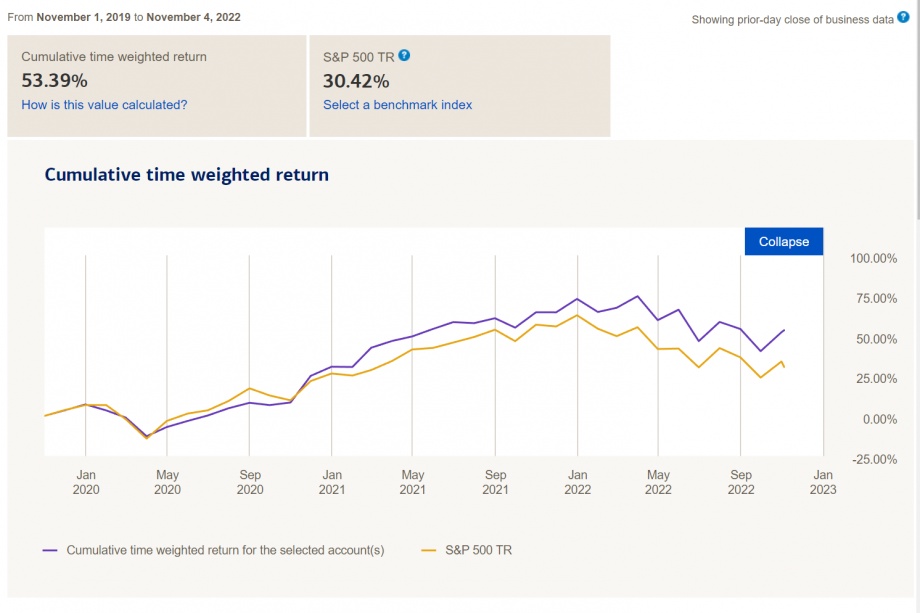

I’LL CONCEDE IT’S HARD to justify—but I don’t believe it’s 100% unjustifiable. At issue: my strategy of overweighting stocks during big market declines. I did so in 2007-09 and early 2020, and I’m doing so today.

“Market timer,” cry the critics. That, in financial circles, ranks as pretty much the nastiest insult you can hurl, even worse than calling someone an “annuity salesman.”

Today, if I ignore the money I’ve set aside for a big home remodeling project, my Vanguard Group account is at 86% stocks, above my 80% target. I started the year at 78%. Since then, I’ve been regularly moving money from my short-term bond funds to my stock funds, so I’ve not merely offset 2022’s fall in share prices, but also driven my stock holdings six percentage points above my target.

All that money has gone into total stock market index funds. I’ve also converted $80,000 of my traditional IRA to my Roth, effectively increasing my stock exposure when calculated on an after-tax basis. Even as I try to make the most of 2022’s stock market slump, I can’t say I’m thrilled about my losses. But I also know I won’t be tapping my portfolio for income for at least a few more years. How can I justify this sort of active asset allocation? Let me offer three contentions.