LRDave

Thinks s/he gets paid by the post

I'm like Jimmy Buffett - "I made enough money to buy Miami, but I pissed it away so fast."

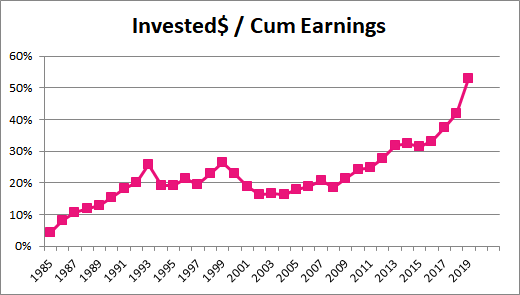

If you don't count the present value of our two COLA'd pensions, when we retired in 2019 our net worth was about 50% of our lifetime earnings.

Gumby looks at 40