The US dollar’s position as the dominant global reserve currency is an immensely important factor in supporting the ballooning US government debt, the Fed’s drunken money-printing, and Corporate America’s ambition to offshore production to cheap countries, thereby creating huge and ever-growing trade deficits. They all have become dependent on the willingness of other central banks to hold large amounts of dollar-denominated paper. But from the looks of things, those central banks might be getting a little nervous.

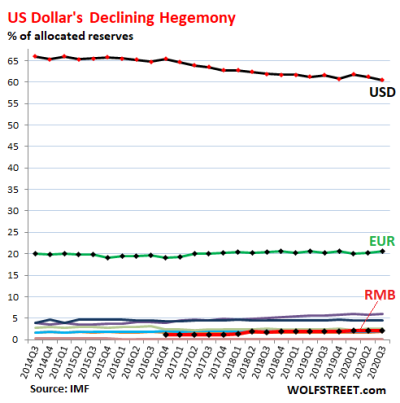

The global share of US-dollar-denominated exchange reserves – US Treasury securities, US corporate bonds, US mortgage-backed securities, etc. held by foreign central banks – fell to 60.5% in the third quarter, according to the IMF’s COFER data release. This is the lowest since 1995. Over the past six years, the dollar’s share has been dropping at a rate of about 1 percentage point per year: