FIREd_2015

Recycles dryer sheets

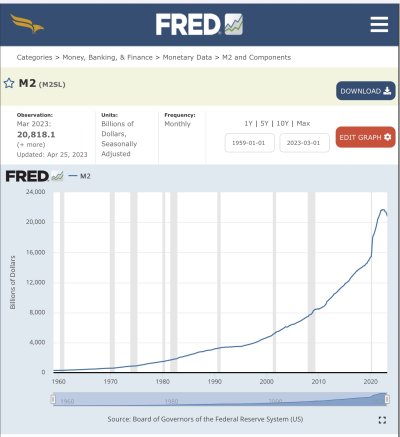

Interesting article about M2 and the possible effect it may have on the economy.

"...Declining money supply in combination with above-average inflation is generally bad news for the U.S. economy. If the cost for goods and services keeps climbing at an above-average pace, and there are fewer dollars and coins in circulation to pay for these goods and services, something typically breaks, leading to a period of deflation and an economic downturn..."

https://www.fool.com/investing/2023/04/30/money-supply-90-years-signal-big-move-for-stocks/

Another article in Reuters

https://www.reuters.com/markets/funds/us-money-supply-falling-fastest-rate-since-1930s-2023-03-29/

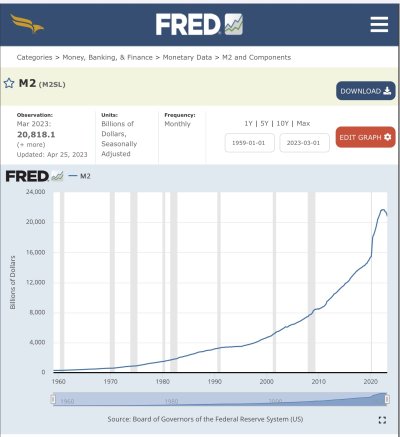

"...Declining money supply in combination with above-average inflation is generally bad news for the U.S. economy. If the cost for goods and services keeps climbing at an above-average pace, and there are fewer dollars and coins in circulation to pay for these goods and services, something typically breaks, leading to a period of deflation and an economic downturn..."

https://www.fool.com/investing/2023/04/30/money-supply-90-years-signal-big-move-for-stocks/

Another article in Reuters

https://www.reuters.com/markets/funds/us-money-supply-falling-fastest-rate-since-1930s-2023-03-29/