yakers

Thinks s/he gets paid by the post

I’m going to start a new thread although I see it as a spin off of the bonds Vs Bond funds thread. Most of that thread addressed the issue of individual bonds Vs an index bond fund. But, as I see it , the issue is wider and needs to consider more alternatives to bond index funds. What about managed bond funds? What about balanced foods like Wellesley and Wellington, and PIMCO income funds, CEFs and the TSP G Fund.

I am trying to simplify my investments as I get older and DW has little interest in things financial. I also don’t want to do something stupid with bonds. Somehow it seems like Wellesley and Wellington have done well enough.

I do own some ibonds and a small amount in short term TIPS. But mainly I changed out a couple fund holdings in my tIRA & Roth IRAs from VG VBIAX Balanced to Wellesley and VG Star fund to Wellington to avoid the BND/bond indexed component. I figure this lets VG manage most of my bond portfolio. Also my largest fixed income holding is the TSP G Fund and while not perfect it certainly is pretty good, predictable and a good part of my FI part of my AA.

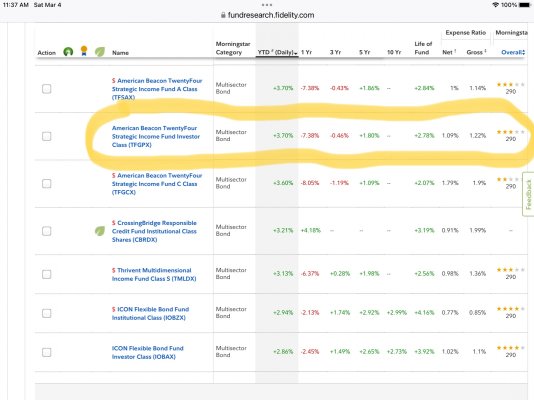

So one is question is what (probably managed) bond funds are good to be holding when interest rates are rising?

Bogleheads advocated a 2 or 3 fund portfolio, would be nice to have something that simple without a bond index fund.

I am trying to simplify my investments as I get older and DW has little interest in things financial. I also don’t want to do something stupid with bonds. Somehow it seems like Wellesley and Wellington have done well enough.

I do own some ibonds and a small amount in short term TIPS. But mainly I changed out a couple fund holdings in my tIRA & Roth IRAs from VG VBIAX Balanced to Wellesley and VG Star fund to Wellington to avoid the BND/bond indexed component. I figure this lets VG manage most of my bond portfolio. Also my largest fixed income holding is the TSP G Fund and while not perfect it certainly is pretty good, predictable and a good part of my FI part of my AA.

So one is question is what (probably managed) bond funds are good to be holding when interest rates are rising?

Bogleheads advocated a 2 or 3 fund portfolio, would be nice to have something that simple without a bond index fund.