pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

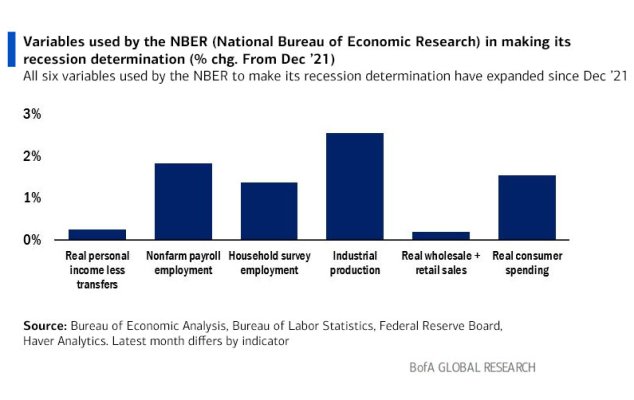

And it's even worse when you look at real world inflation vs. the lower government figures. I hear that income is up, yet it's actually down when factoring in inflation, and that's even using the government inflation figures, which make it seem better than reality.

And just what is the authoratitive source for your "real world inflation"? Or is "real world inflation" anecdotal based on GenXguy's experience and view of the world?

I'm pretty sure that wherever it was reported that income was up that it was also indicated that it was nominal income and not real income.

Wrong, that is absolutely NOT the case.

Ok, I'm confused. What Michael posted indicates that personal income in current dollars increased 0.6% in June... so I stand corrected it was real income and not nominal.

Yet you (GenXguy) wrote that income was up but it was actually down when factoring in inflation... that is false. It was up after considering inflation. It seemed to me that you were suggesting that the announced increase in income was somehow misleading... but it wasn't.