You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Market to hit all-time high this morning !

- Thread starter Blue531

- Start date

38Chevy454

Thinks s/he gets paid by the post

I am not ready to claim a specific reason(s), but I am not complaining about it! Ride the wave....

I am not ready to claim a specific reason(s), but I am not complaining about it! Ride the wave....

+1

Probably a good idea to keep election talk on the sidelines for now.

ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Dow going to go over 30K, a new all-time high after years of pushing the limit. INSERT ANY REASON YOU CAN THINK OF pushing it over the edge.

I made a slight correction.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

It's the announcement made by Pfizer of its vaccine.

Clinical Phase 3 trial on more than 43,000 participants, inside and outside the US, shows 90% efficacy in preventing infection.

Pfizer projects vaccine to be available before year end, and 1.3 billion doses in 2021.

See thread on vaccine: https://www.early-retirement.org/forums/f55/vaccine-trials-105297-2.html#post2508096

PS. Sectors that go up the most today are the ones most depressed by the pandemic. Energy and travel are two examples. Stocks up 10 to 30%.

Stocks that are driven up by the pandemic see no reason to go higher, for example Amazon and Netflix. They are down as of this posting.

Clinical Phase 3 trial on more than 43,000 participants, inside and outside the US, shows 90% efficacy in preventing infection.

Pfizer projects vaccine to be available before year end, and 1.3 billion doses in 2021.

See thread on vaccine: https://www.early-retirement.org/forums/f55/vaccine-trials-105297-2.html#post2508096

PS. Sectors that go up the most today are the ones most depressed by the pandemic. Energy and travel are two examples. Stocks up 10 to 30%.

Stocks that are driven up by the pandemic see no reason to go higher, for example Amazon and Netflix. They are down as of this posting.

Last edited:

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,569

WOW!!

1250 points up 4.28% market gain as of a few minutes ago. Crazy!!

1250 points up 4.28% market gain as of a few minutes ago. Crazy!!

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Pfizer news is great, the problem might be where I might fit on the list!

I think everyone would agree that healthcare workers deserve to be 1st.

Without medical experience, one may want to apply for an orderly job to be given priority.

WOW!!

1250 points up 4.28% market gain as of a few minutes ago. Crazy!!

No, it's not crazy. The vaccine news is a major development.

The Dow goes up the most, as it has more depressed stocks. The Nasdaq does not go up as much, because it has a lot of stocks whose business is buoyed by people getting shut in by the pandemic. The latter don't deserve to go higher.

tenant13

Full time employment: Posting here.

The vaccine news is a major development.

To me this was always the one and only factor that would influence the economy. I would not assume that we're in the clear though. It remains to be seen whether that promised 90% efficacy is real, if there are no unforeseen side effects and whether the complicated distribution chain will deliver the vaccine to all who want it. Plus there's a timeline: it can all take years before we're back to pre-pandemic life; if that's actually at all in the cards.

Having said that, I'm really, really happy about this announcement.

WyomingLife

Recycles dryer sheets

This could be one of those days that reminds us again why "time in the market, not timing the market" matters.

Per Fidelity, missing out on the best days can be costly: https://www.fidelity.com/viewpoints/investing-ideas/six-tips.

Have a plan, set an AA, stay buckled in, and let it ride.

Per Fidelity, missing out on the best days can be costly: https://www.fidelity.com/viewpoints/investing-ideas/six-tips.

Have a plan, set an AA, stay buckled in, and let it ride.

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,569

Thanks NW.I think everyone would agree that healthcare workers deserve to be 1st.

Without medical experience, one may want to apply for an orderly job to be given priority.

No, it's not crazy. The vaccine news is a major development.

The Dow goes up the most, as it has more depressed stocks. The Nasdaq does not go up as much, because it has a lot of stocks whose business is buoyed by people getting shut in by the pandemic. The latter don't deserve to go higher.

You keep schooling me and I appreciate that very much.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

To me this was always the one and only factor that would influence the economy. I would not assume that we're in the clear though. It remains to be seen whether that promised 90% efficacy is real, if there are no unforeseen side effects and whether the complicated distribution chain will deliver the vaccine to all who want it. Plus there's a timeline: it can all take years before we're back to pre-pandemic life; if that's actually at all in the cards.

Having said that, I'm really, really happy about this announcement.

Contrary to the earlier announcements by startup companies, this one by Pfizer was made after a clinical Phase 3 involving 43,000 people over the world. This candidate vaccine is a lot further along, and Pfizer has not publicized it until now. Makes me wonder if other major pharmas also have something else like this.

Anyway, the market always looks ahead, and tries to price the stocks for the future. A quick look at my stocks shows the ones that gain the most today are the ones beaten down the worst by the virus. My top 2: Valero (oil refinery), and Sysco (restaurant supplier).

There's light at the end of the pandemic tunnel! Heh heh heh...

Last edited:

ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't normally trade on the news, but I was up pretty early and saw what was going on with PFE...and I jumped on the bandwagon. It continued to go up, up, up and I decided to sell...a mere hour after I bought it. Gambling? Perhaps...but it paid off *this* time.

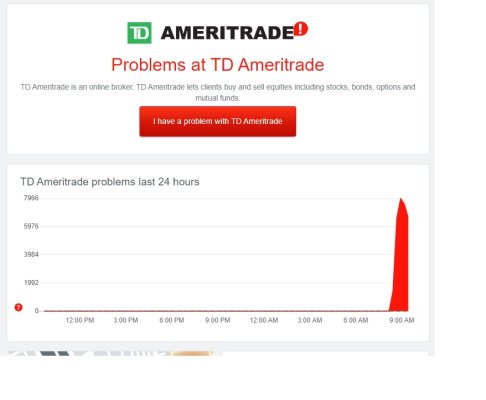

I am VERY glad I got out, because now I am seeing/hearing that most of the trade platforms are not working...TDA's Thinkorswim won't even open for me right now.

I am VERY glad I got out, because now I am seeing/hearing that most of the trade platforms are not working...TDA's Thinkorswim won't even open for me right now.

Attachments

- Joined

- Nov 17, 2015

- Messages

- 13,986

This could be one of those days that reminds us again why "time in the market, not timing the market" matters.

Per Fidelity, missing out on the best days can be costly: https://www.fidelity.com/viewpoints/investing-ideas/six-tips.

Have a plan, set an AA, stay buckled in, and let it ride.

This is true, but I'm pretty happy that, on Friday, we moved a bunch of stuff that had been taken off the table in May back into the market.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Thanks NW.

You keep schooling me and I appreciate that very much.

Although I try to stay diversified, I do that by owning a mixture of stocks or sector ETFs, instead of owning diversified mutual funds or index funds.

I like to see what is going on in the making of the sausage, actually making my own type of sausage.

And it's fun for me to see some of my stocks go up while some go down, and for me to figure out why.

My observations are all made after the fact. To make a lot of money requires making good predictions, which is infinitely harder.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Dow going to go over 30K, a new all-time high after years of pushing the limit. Election result pushing it over the edge.

Futures were pretty high before the Pfizer announcement, but then that really goosed them!

Well, it got close.

Last edited:

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Value stocks are outperforming growth today. Vaccine news is great!!!

My guess is that small cap value would be a good short term bet.

Current order of performance with some ETF's as purchase examples:

small cap value VBR

large cap value VTV

international small cap SCZ

international large cap VEU

Bonds down a lot. I am tempted to buy some VBR.

My guess is that small cap value would be a good short term bet.

Current order of performance with some ETF's as purchase examples:

small cap value VBR

large cap value VTV

international small cap SCZ

international large cap VEU

Bonds down a lot. I am tempted to buy some VBR.

Last edited:

WyomingLife

Recycles dryer sheets

This is true, but I'm pretty happy that, on Friday, we moved a bunch of stuff that had been taken off the table in May back into the market.

That's terrific.

I'm certain it is due to various and sundry personal defects on my part (e.g., sloth-like laziness, lack of creativity), we've never taken anything out of the market since we started way back in 1986. A couple of years back, due to health reasons, we sold a small position to bulk up what might be deemed an EF. Aside from that one-time event and annual rebalancing, however, we've literally never done anything other than continue to dribble amounts in every month, and let it ride. Boring #101.

For the bulk of those decades, our AA was nearly 100/0/0. As we hit our 50's, we did some tweaking to protect the nut.

Along the way, when faced with a market drop, we heard variations on this: "But this time is different, so get out." We stayed in. And so far at least, it turns out nothing ever was different.

So my suggestion to youth (and this is not investing advice; YMMV; the bottom could drop out later today; and the civilization-ending meteor strike could occur shortly thereafter): invest early and often, and then don't pay attention to the news. And if you do pay attention to the news, don't do anything. Stay invested, play the long game. Boring is good.

Last edited:

targatom2019

Recycles dryer sheets

Good thing I went from 60/40 to 95/5 in March.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Some quotes from an AP News vaccine article:

Source: https://apnews.com/article/pfizer-vaccine-effective-early-data-4f4ae2e3bad122d17742be22a2240ae8

Dr. Anthony Fauci, the government’s top-infectious disease expert, said the results suggesting 90% effectiveness are “just extraordinary,” adding: “Not very many people expected it would be as high as that.”

“It’s going to have a major impact on everything we do with respect to COVID,” Fauci said.

“We need to see the data, but this is extremely promising,” said Dr. Jesse Goodman of Georgetown University, former chief of the FDA’s vaccine division. He ticked off many questions still to be answered, including how long the vaccine’s effects last and whether it protects older people as well as younger ones.

Source: https://apnews.com/article/pfizer-vaccine-effective-early-data-4f4ae2e3bad122d17742be22a2240ae8

Out-to-Lunch

Thinks s/he gets paid by the post

Value stocks are outperforming growth today. Vaccine news is great!!!

My guess is that small cap value would be a good short term bet.

Current order of performance with some ETF's as purchase examples:

small cap value VBR

large cap value VTV

international small cap SCZ

international large cap VEU

Bonds down a lot. I am tempted to buy some VBR.

Funny! I saw the same news and I am planning to sell my small-cap value and large-cap value positions in order to unwind a modest small/value tilt I have had for years. I've been interested in simplifying my portfolio, but the small/value beat-down (irrationally?) kept me from doing so.

USGrant1962

Thinks s/he gets paid by the post

I get the stock market relief rally on vaccine news. I don't get why bonds are getting crushed?

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Because expectation of economic resurgence/recovery also means interest rates aren't expected to be held down as long.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

^Also because people are presumably selling bonds to obtain the cash to buy stocks.

Interesting to me to see bank stocks up so much and the reasoning why. See JPM for example.

Interesting to me to see bank stocks up so much and the reasoning why. See JPM for example.

Similar threads

- Replies

- 2

- Views

- 605

- Replies

- 22

- Views

- 1K

- Replies

- 6

- Views

- 1K