marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,471

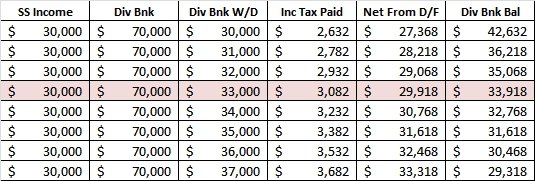

Friends, I've often mentioned that 'numbers is hard' for me but this is not a calculation problem as much as a math logic problem, which often is my greater challenge.

I'm trying to understand how much I'll have left at the end of 2023 but I'm getting a migraine over this.

Here's the numbers (fake numbers for simplicity and privacy; forget about taxes for now)

Total spending available: dividend bank 70K plus SS 30K=100K

Expected spending: 60K

Need to withdraw from dividend bank: 30K (60K minus 30K from SS)

So, is my surplus 40K? (70 dividends minus 30 withdrawn) or, because SS is part of the 100K is my surplus 70K (100 minus 30 withdrawn)?

Per usual, I'm sure I'm missing something and yes, I'm an idiot on these things; not sure how I managed to FI so well sometimes. (audreyh1 where are you?)

I'm trying to understand how much I'll have left at the end of 2023 but I'm getting a migraine over this.

Here's the numbers (fake numbers for simplicity and privacy; forget about taxes for now)

Total spending available: dividend bank 70K plus SS 30K=100K

Expected spending: 60K

Need to withdraw from dividend bank: 30K (60K minus 30K from SS)

So, is my surplus 40K? (70 dividends minus 30 withdrawn) or, because SS is part of the 100K is my surplus 70K (100 minus 30 withdrawn)?

Per usual, I'm sure I'm missing something and yes, I'm an idiot on these things; not sure how I managed to FI so well sometimes. (audreyh1 where are you?)