Anyone been using this? I recently heard a podcast where they were interviewing the CEO and it caught my attention. I have to admit, with interest rates so low and the interest paid on money markets being basically nothing, I have gotten lazy and just let me cash sit in my checking or brokerage acct, basically earning nothing. While I could open 1 or 2 online savings accounts and continually shop for the best yield, I suppose I am to lazy to do the exercise and then see them drop their yield, and then rinse and repeat the exercise. Max My Interest, https://www.maxmyinterest.com/, seems to be designed for lazy peeps like me. They charge .02% per quarter, but claim to get a yield above their cost compared with what you can get on your own. I generally have $300K - $500K in cash at any given time so just started thinking, even if it's just $2K a year in interest, it may be better than a sharp stick in the eye, especially if I don't need to do anything after the initial set up. Anyone have experience here?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

maxmyinterest.com...Anyone?

- Thread starter DawgMan

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

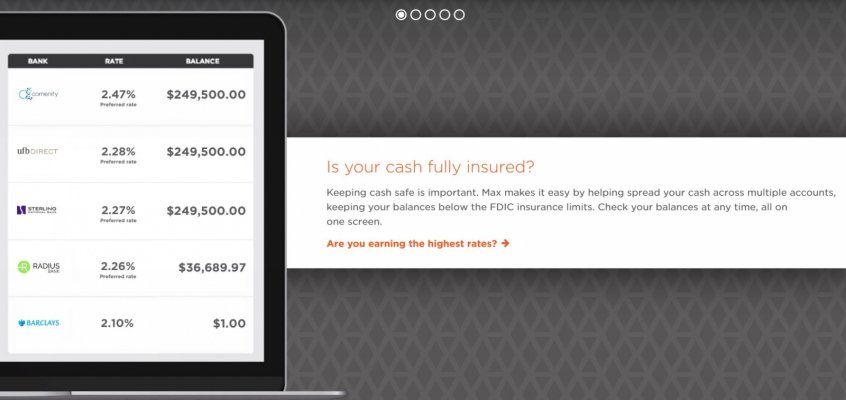

Unless the account/deposit is with an FDIC insured bank, I would avoid it. IOW, looking at the screenshot from their website below, if there is an FDIC insured account in my name at Comenity with $249,500 in it and an FDIC insured account in my name at Radius Bank with $36,689.97 in it then I would be game... otherwise not.

The better question might be why so much cash? Why not a couple online svings accounts?... rates fell last summer but have seemed to stabilize around 0.5%-0.6%.

Would you qualify for NFCU? Have you looked at alternatives like DERI or Toyota IncomeDriver notes or Duke Energy PremierNotes? More risk but also more return and good liquidity. YMMV.

The better question might be why so much cash? Why not a couple online svings accounts?... rates fell last summer but have seemed to stabilize around 0.5%-0.6%.

Would you qualify for NFCU? Have you looked at alternatives like DERI or Toyota IncomeDriver notes or Duke Energy PremierNotes? More risk but also more return and good liquidity. YMMV.

Attachments

Last edited:

yourbestinterest

Confused about dryer sheets

Hi, I'm the CEO of MaxMyInterest and happy to answer any questions. Short answer is yes, you choose which banks you want and all accounts are held directly by you, in your own name, FDIC-insured, so that you can maximize FDIC insurance coverage while earning above-market rates.

Max is just a communications platform that helps you tell your banks when to send funds between one another so that you can always earn the highest yield, even as rates change. Max never touches any money and you can login directly to any of your accounts at any of the banks at any time. Top rate today is 0.75%. Admittedly, rates are much lower now than they were a year ago (it's hard to get excited about 0.75%!), but 0.75% is still 25bps higher than most of the other nationally-advertised online banks.

You're right that you can earn higher yield by buying bonds, and you may choose to hold no cash at all. But if you happen to hold cash, our view is that 1) it should be fully-liquid, 2) it should be fully-insured, and 3) it should yield as much as possible.

Max wasn't originally intented to be a company -- it was just my own nerdy way of managing my own cash. But I found that a lot of my colleagues needed this solution, too, so I left my job in 2013 to turn it into a secure solution that other people could use as well. Hope you find it helpful. And don't hesitate to ping me with any other questions (cash or otherwise).

Max is just a communications platform that helps you tell your banks when to send funds between one another so that you can always earn the highest yield, even as rates change. Max never touches any money and you can login directly to any of your accounts at any of the banks at any time. Top rate today is 0.75%. Admittedly, rates are much lower now than they were a year ago (it's hard to get excited about 0.75%!), but 0.75% is still 25bps higher than most of the other nationally-advertised online banks.

You're right that you can earn higher yield by buying bonds, and you may choose to hold no cash at all. But if you happen to hold cash, our view is that 1) it should be fully-liquid, 2) it should be fully-insured, and 3) it should yield as much as possible.

Max wasn't originally intented to be a company -- it was just my own nerdy way of managing my own cash. But I found that a lot of my colleagues needed this solution, too, so I left my job in 2013 to turn it into a secure solution that other people could use as well. Hope you find it helpful. And don't hesitate to ping me with any other questions (cash or otherwise).

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Very interesting.

So is MaxMyInterest similar to a brokerage firm in a way.... coordinate depoitors having relationships with a number of banks? Does it reduce the hassle of opending accounts at different banks? IOW, if I have money in Bank A via MaxMyInterest and Bank B comes along and offers a better rate what is involved in moving that money from Bank A to Bank B to capture the higher rate? If it is as easy as moving money from money market fund A to money market fund B at my brokerage firm then I can see a benefit.

IOW, take the friction out of moving money between online savings accounts to be able to shop for the best rate with less hassle.

Is the 0.75% before or after the 0.08% fee?

So is MaxMyInterest similar to a brokerage firm in a way.... coordinate depoitors having relationships with a number of banks? Does it reduce the hassle of opending accounts at different banks? IOW, if I have money in Bank A via MaxMyInterest and Bank B comes along and offers a better rate what is involved in moving that money from Bank A to Bank B to capture the higher rate? If it is as easy as moving money from money market fund A to money market fund B at my brokerage firm then I can see a benefit.

IOW, take the friction out of moving money between online savings accounts to be able to shop for the best rate with less hassle.

Is the 0.75% before or after the 0.08% fee?

yourbestinterest

Confused about dryer sheets

Similar, except that Max is not a broker and never takes custody of funds. All deposits remain in your own bank accounts, and Max doesn't get paid by banks for deposits (if we did, that would introduce a conflict of interest, and we wanted to create something that was pure and transparent.)

Max monitors interest rates daily, and as banks change their rates, Max can tell your banks when you'd like to move funds from your account at Bank A to your account at Bank B. That way, you can always earn the highest yield and don't need to worry about rate-chasing. This all happens automatically, and you can change the settings at any time.

Simple idea in principle, but early on it was a pain to open multiple bank accounts. So in 2015 we began work on the Max Common Application (U.S. Patent #10,510,082), which made it possible to open mulitple bank accounts by filling out a single form. With the Max Common Application, accounts open in as little as 60 seconds. We now support 5 banks on the common app, with more to come in 2021.

With Max, you earn 100% of the interest paid directly from each bank. Then Max charges 0.02% per quarter (0.08% per year) for its service. Max doesn't sell data or cross-sell any other products. It's just a simple fee-for-service business, where we made the fee transparent rather than try to hide it. So to answer your question, on amounts <$250k, at current rates you'd earn 0.75%, then pay 0.08% over the course of year, so your net yield would be 0.67%.

If you like, we also offer the option of a checking account called Max Checking (that also opens in <60 seconds using the Max Common Application). If you use Max Checking, our partner bank will cover up to 100% of that membership fee so you could earn the full 0.75%. (Max earns zero on Max Checking -- we simply offer it for your convenience, but it's a pretty neat account that pays 0.20% on checking and includes free wire transfers and free ATM access at any ATM worldwide).

Happy to answer any other questions you might have. I've been using Max for my own accounts since 2014, and before that executed the underlying strategy manually since 2009. Advisors from ~1,200 wealth management firms are reegistered to use Max with their clients as well -- most of them are RIAs (fiduciaries). Hope you find it helpful.

Max monitors interest rates daily, and as banks change their rates, Max can tell your banks when you'd like to move funds from your account at Bank A to your account at Bank B. That way, you can always earn the highest yield and don't need to worry about rate-chasing. This all happens automatically, and you can change the settings at any time.

Simple idea in principle, but early on it was a pain to open multiple bank accounts. So in 2015 we began work on the Max Common Application (U.S. Patent #10,510,082), which made it possible to open mulitple bank accounts by filling out a single form. With the Max Common Application, accounts open in as little as 60 seconds. We now support 5 banks on the common app, with more to come in 2021.

With Max, you earn 100% of the interest paid directly from each bank. Then Max charges 0.02% per quarter (0.08% per year) for its service. Max doesn't sell data or cross-sell any other products. It's just a simple fee-for-service business, where we made the fee transparent rather than try to hide it. So to answer your question, on amounts <$250k, at current rates you'd earn 0.75%, then pay 0.08% over the course of year, so your net yield would be 0.67%.

If you like, we also offer the option of a checking account called Max Checking (that also opens in <60 seconds using the Max Common Application). If you use Max Checking, our partner bank will cover up to 100% of that membership fee so you could earn the full 0.75%. (Max earns zero on Max Checking -- we simply offer it for your convenience, but it's a pretty neat account that pays 0.20% on checking and includes free wire transfers and free ATM access at any ATM worldwide).

Happy to answer any other questions you might have. I've been using Max for my own accounts since 2014, and before that executed the underlying strategy manually since 2009. Advisors from ~1,200 wealth management firms are reegistered to use Max with their clients as well -- most of them are RIAs (fiduciaries). Hope you find it helpful.

Anyone been using this? I recently heard a podcast where they were interviewing the CEO and it caught my attention. I have to admit, with interest rates so low and the interest paid on money markets being basically nothing, I have gotten lazy and just let me cash sit in my checking or brokerage acct, basically earning nothing. While I could open 1 or 2 online savings accounts and continually shop for the best yield, I suppose I am to lazy to do the exercise and then see them drop their yield, and then rinse and repeat the exercise. Max My Interest, https://www.maxmyinterest.com/, seems to be designed for lazy peeps like me. They charge .02% per quarter, but claim to get a yield above their cost compared with what you can get on your own. I generally have $300K - $500K in cash at any given time so just started thinking, even if it's just $2K a year in interest, it may be better than a sharp stick in the eye, especially if I don't need to do anything after the initial set up. Anyone have experience here?

Just open an online savings account (Ally, Synchrony, etc) and forget about it. Very little effort; no need to always search for another bank offering .1% more.

Just open an online savings account (Ally, Synchrony, etc) and forget about it. Very little effort; no need to always search for another bank offering .1% more.

Curious, for those of you who have used these online banks over the years, what has typically been the spread between competing banks? It looks like today its around 20% (.50% vs .60%). On $300K cash, that extra 20% pays you an extra $300 ($1800 vs $1500)... perhaps a nice dinner with DW? Obviously, as you said, chasing .10% is allot of brain damage. How often does one of these top yielding banks tease with a high yield and then fall to the back of the group? I suppose the Max site keeps you always in the highest yielding account and suggests the net yield after their fee is still above what you can get on your own.

The Max concept caught my attention so just curious as to what the group had to say.

Curious, for those of you who have used these online banks over the years, what has typically been the spread between competing banks? It looks like today its around 20% (.50% vs .60%). On $300K cash, that extra 20% pays you an extra $300 ($1800 vs $1500)... perhaps a nice dinner with DW? Obviously, as you said, chasing .10% is allot of brain damage. How often does one of these top yielding banks tease with a high yield and then fall to the back of the group? I suppose the Max site keeps you always in the highest yielding account and suggests the net yield after their fee is still above what you can get on your own.

I don't track the major players religiously, but it seems to me they are always within .1 or .2 of each other.

I used to chase such tiny differences. At some point, I got tired of it.

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

PB; What are you seeing at NFCU that I am not seeing as a place for cash? I have a CD maturing from Navy next week. The only thing to keep me there is to roll it into an Add on at .9% that I started last year, but that will mature in June, so short term.Unless the account/deposit is with an FDIC insured bank, I would avoid it. IOW, looking at the screenshot from their website below, if there is an FDIC insured account in my name at Comenity with $249,500 in it and an FDIC insured account in my name at Radius Bank with $36,689.97 in it then I would be game... otherwise not.

The better question might be why so much cash? Why not a couple online svings accounts?... rates fell last summer but have seemed to stabilize around 0.5%-0.6%.

Would you qualify for NFCU? Have you looked at alternatives like DERI or Toyota IncomeDriver notes or Duke Energy PremierNotes? More risk but also more return and good liquidity. YMMV.

I've asked you what DERI is before. Can't recall your response.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1 hardly worth the effort because I don't bother to keep a large cash balance anymore... I used to target 5% of total assets but decided that I didn't need that much.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

PB; What are you seeing at NFCU that I am not seeing as a place for cash? I have a CD maturing from Navy next week. The only thing to keep me there is to roll it into an Add on at .9% that I started last year, but that will mature in June, so short term.

I've asked you what DERI is before. Can't recall your response.

I'm not seeing much lately from NFCU though their CD rates seem to be consistently near the front of the pack even though they are low. For example, their current 5-year CD is 0.90% (0.95% for $100k+) compared to 0.75% for PenFed and a nationwide average of ~0.35%.

I have 1-year 1.35% NFCU CDs that mature in May and 17-month 2.25% NFCU CDs that mature in August but I'm not keen to lock up for my money for 0.50% or less so I'm not sure what I'll do when those mature.

DERI is Dominion Energy Reliability Investment Notes.... it functions like a savings account in that you can deposit or withdraw money at will. It currently pays 1.5% for balances over $10k. Toyota Motor Credit Corp has a similar program called Toyota IncomeDriver Notes (currently 1.5%) and Duke Energy had a similar program called Duke Energy Premier Notes (currently 0.85%). Of course, not FDIC insured so credit risk of the issuer but IMO still pretty attractive rates... higher risk and higher reward. YMMV.

Last edited:

- Joined

- Oct 13, 2010

- Messages

- 10,763

I presume that the depositor's online bank credentials are held at Max? So if there were a hack there, it would be quite the "oopsie daisy!" That's picking up a penny in front of a freight train!

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Is it just me or is anyone freaked out by the fact that the CEO of this website chimed in shortly after it was mentioned in this post.

- Joined

- Oct 13, 2010

- Messages

- 10,763

This board is indexed by Google, so, no. Any good CEO is watching what comes up on Internet searches for his company.

yourbestinterest

Confused about dryer sheets

Thank you for all the great comments and feedback. We've continuously improved the platforom over the past 7 years based on comments from clients and their financial advisors.

it is possible to enroll for Max, open up a high-yield checking account and up to 5 online savings accounts without ever sharing any login credentials, and in less time than it takes to open an account at any of the online bank websites directly. For the majority of our online banks, Max has direct connections that enable us to communicate securely without the need for any logins or passwords. (But you can also choose to link accounts at Ally, Amex, etc., and those still do require passwords if you want to add those accounts.)

Historically, Max's top yield has been ~20-30 bps above-market. Plus with the automatic rebalancing, you can usually pick up an extra ~10 bps since Max is keeping on top of the best rates for you.

While we've made Max available to anyone (no minimum balance), most Max members are holding several hundred thousand to a few million in cash... so if you're keeping less than $50k in cash, it may be of marginal benefit and you might conclude it's not worth your time.

I did indeed notice this board because of a Google notification, and was happy to learn about it. We have a lot of FIRE members who are focused on every financial detail of their lives, and I love the lively discussion -- direct input from customers or prospetive customers helps us learn and make continuous improvements.

I completely agree that chasing rates isn't worth your time -- I did it manually for 3.5 years before coming to that same conclusion. That's why we created Max -- so that software could help you manage your accounts so that you don't have to spend your time doing so. Our typical customer earns thousands to tens of thousands of dollars of incremental yield each year. Not life-changing, but seems silly to leave money on the table when it's rightfully yours.

it is possible to enroll for Max, open up a high-yield checking account and up to 5 online savings accounts without ever sharing any login credentials, and in less time than it takes to open an account at any of the online bank websites directly. For the majority of our online banks, Max has direct connections that enable us to communicate securely without the need for any logins or passwords. (But you can also choose to link accounts at Ally, Amex, etc., and those still do require passwords if you want to add those accounts.)

Historically, Max's top yield has been ~20-30 bps above-market. Plus with the automatic rebalancing, you can usually pick up an extra ~10 bps since Max is keeping on top of the best rates for you.

While we've made Max available to anyone (no minimum balance), most Max members are holding several hundred thousand to a few million in cash... so if you're keeping less than $50k in cash, it may be of marginal benefit and you might conclude it's not worth your time.

I did indeed notice this board because of a Google notification, and was happy to learn about it. We have a lot of FIRE members who are focused on every financial detail of their lives, and I love the lively discussion -- direct input from customers or prospetive customers helps us learn and make continuous improvements.

I completely agree that chasing rates isn't worth your time -- I did it manually for 3.5 years before coming to that same conclusion. That's why we created Max -- so that software could help you manage your accounts so that you don't have to spend your time doing so. Our typical customer earns thousands to tens of thousands of dollars of incremental yield each year. Not life-changing, but seems silly to leave money on the table when it's rightfully yours.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,244

Nah, DawgMan has been around long enough that I don't think they are a shill. I think it's great to have the CEO come on here to answer questions, and explain details rather than just hyping it. Interesting product.Is it just me or is anyone freaked out by the fact that the CEO of this website chimed in shortly after it was mentioned in this post.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+1

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Nah, DawgMan has been around long enough that I don't think they are a shill. I think it's great to have the CEO come on here to answer questions, and explain details rather than just hyping it. Interesting product.

Just to be clear. I wasn't inferring anything nefarious about Dawgman. Just another example of how our lives are an open book to the cyber world. Actually, the concept of the platform seems at first glance good, but I've never used any of the banks that are in their line up. If Ally or Marcus or Synchrony or CapOne were in their stable it might be of interest. If more banks sign on maybe joining will be in my future.

copyright1997reloaded

Thinks s/he gets paid by the post

Thank you for all the great comments and feedback. We've continuously improved the platforom over the past 7 years based on comments from clients and their financial advisors.

it is possible to enroll for Max, open up a high-yield checking account and up to 5 online savings accounts without ever sharing any login credentials, and in less time than it takes to open an account at any of the online bank websites directly. For the majority of our online banks, Max has direct connections that enable us to communicate securely without the need for any logins or passwords. (But you can also choose to link accounts at Ally, Amex, etc., and those still do require passwords if you want to add those accounts.)

Historically, Max's top yield has been ~20-30 bps above-market. Plus with the automatic rebalancing, you can usually pick up an extra ~10 bps since Max is keeping on top of the best rates for you.

While we've made Max available to anyone (no minimum balance), most Max members are holding several hundred thousand to a few million in cash... so if you're keeping less than $50k in cash, it may be of marginal benefit and you might conclude it's not worth your time.

I did indeed notice this board because of a Google notification, and was happy to learn about it. We have a lot of FIRE members who are focused on every financial detail of their lives, and I love the lively discussion -- direct input from customers or prospetive customers helps us learn and make continuous improvements.

I completely agree that chasing rates isn't worth your time -- I did it manually for 3.5 years before coming to that same conclusion. That's why we created Max -- so that software could help you manage your accounts so that you don't have to spend your time doing so. Our typical customer earns thousands to tens of thousands of dollars of incremental yield each year. Not life-changing, but seems silly to leave money on the table when it's rightfully yours.

I just wanted to thank you for participating in the thread and answering questions.

p.s. I wonder if you put a child (or two) through college and used the "common app" (and thus use the term). Hopefully, Max's common app is easier to use than the college one.

yourbestinterest

Confused about dryer sheets

Ha! No, I applied for college a few years before the common app existed, and my kids aren't college age yet, but one of our investors happens to own the common app for applying to grad school (the common app for college is a non-profit) so they were helpful as we thought through how best to approach simplifying account opening.

Would definitely welcome your feedback on the Max Common App to the extent you try it out.

Would definitely welcome your feedback on the Max Common App to the extent you try it out.

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,188

Curious, for those of you who have used these online banks over the years, what has typically been the spread between competing banks? It looks like today its around 20% (.50% vs .60%). On $300K cash, that extra 20% pays you an extra $300 ($1800 vs $1500)... perhaps a nice dinner with DW? Obviously, as you said, chasing .10% is allot of brain damage. How often does one of these top yielding banks tease with a high yield and then fall to the back of the group? I suppose the Max site keeps you always in the highest yielding account and suggests the net yield after their fee is still above what you can get on your own.

I choose to simplify things and use only Capital One and Ally. They are almost always among the best in yield, and if the spread is great enough I will move them between the two. Wen rates were higher the spread was a little bigger - I don't track them but I thought at one point Ally was greater than Capital One by more than 20%.

Going beyond what I do might get me a little more, but I am fine with what I have for now.

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

It looks like there is another competitor to MaxMyInterst.com. https://www.savebetter.com/ is mentioned on the Deposit Accounts Bank Deals Blog that I check regularly. This one though apparently also focuses on bonuses in addition to yields. The problem I see with both of these that I see is that so far none of the participating banks are well known mainstream banks. That may change though.

Similar threads

- Replies

- 17

- Views

- 760

- Replies

- 41

- Views

- 3K

- Replies

- 5

- Views

- 627

Latest posts

-

-

-

-

In Your City - What Are The Most Desirable Neighborhoods and Why?

- Latest: ShokWaveRider

-

-

-

-

-