Crabby Mike

Recycles dryer sheets

OK, so this is probably either something everybody but me already knew, or else I'm just misunderstanding it ...

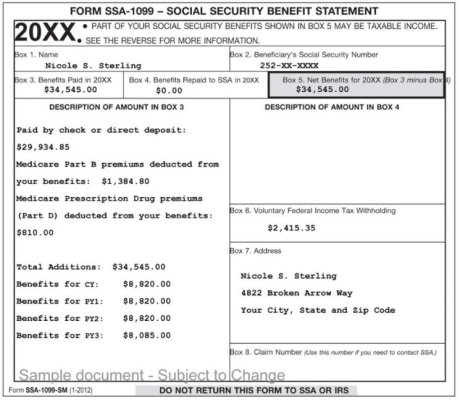

I just started Medicare this year at 65, and plan to begin taking Social Security next year at 66 (my FRA), so for now I'm paying my Part B premium and IRMAA surcharge by ACH payment thru my bank. I was recently working on income and expense projections for the coming years, and found (if I'm reading this right) that the Social Security income I'll be reporting on my taxes will be net of the Medicare deductions. Is this true? If so, then my Medicare costs are effectively deductible (taken from pre-tax income, like the health insurance premiums that used to be taken from my paycheck) if deducted from Social Security, but not if paid directly like I'm doing now (since like most people, I will now be taking the higher standard deduction and no long itemizing). I'm too lazy to tackle the math right now, but it seems like that could significantly alter the "when to take Social Security" decision, at least starting at 65 vs. later.

Or am I missing something?

I just started Medicare this year at 65, and plan to begin taking Social Security next year at 66 (my FRA), so for now I'm paying my Part B premium and IRMAA surcharge by ACH payment thru my bank. I was recently working on income and expense projections for the coming years, and found (if I'm reading this right) that the Social Security income I'll be reporting on my taxes will be net of the Medicare deductions. Is this true? If so, then my Medicare costs are effectively deductible (taken from pre-tax income, like the health insurance premiums that used to be taken from my paycheck) if deducted from Social Security, but not if paid directly like I'm doing now (since like most people, I will now be taking the higher standard deduction and no long itemizing). I'm too lazy to tackle the math right now, but it seems like that could significantly alter the "when to take Social Security" decision, at least starting at 65 vs. later.

Or am I missing something?