I think it's common, when you're younger, to believe you're going to work forever. Old age just seems like it's an eternity away, and people tend to have that youthful optimism that they think will go on forever.

However, I'm surprised that it was that young, 57, in 1991. However, back then pensions were a lot more common, including the types that would let you take an early retirement. For instance, I have a friend who's a high school teacher. I think he can get his pension with its maximum benefit, after 30 years of service, and age at the time is irrelevant.

In my friend's case, I think it's 54% of your best 3 or 5 years or whatever. And in his case, I think he hits 30 years at the age of 54 or 55. Oddly, he thinks this is a crap pension, but I've tried to stress to him, remember, that when he's retired he's no longer paying INTO that pension, which is 7% of his salary. And, he's no longer paying into SS/Medicare, either so that's another 7.65%. So that 54% of his salary is more like 69%. If he takes SS early at 62, I imagine that would push him back up to around 85-90% of his original salary.

I think those types of plans are still common among state/county type employees. But I wonder if they were just more common in general, back then?

My maternal Granddad took an early retirement from the federal gov't, at the age of 55, in 1971 to help take care of one of Grandmom's aunts. She died within a year, but Granddad felt no compelling urge to return to the workforce. Grandmom was sort of forced into early retirement from the federal gov't at the age of 56, when our local Glenn Dale Hospital got shuttered. That was the end of 1980. She went back to work though, doing transcription work for some doctors she knew, and then doing part time/on-call doing medical records at a local hospital, until she finally gave it up for good at the age of 70. On my Dad's side, Granddad retired from the Pennsylvania Railroad in 1974, at the age of 60. He had 35 years in, and from what I've heard, those railroad pensions were like gold. Dunno if that's the case these days, though. Grandmom ended up retiring the same year. She would've been 56-57.

Now, I'm sure a lot changed from the 1970's to 1991 with regards to retirement. But, back then there were still a lot of retirees from earlier eras reporting. In 1991, for example, 3 of my 4 grandparents were still alive.

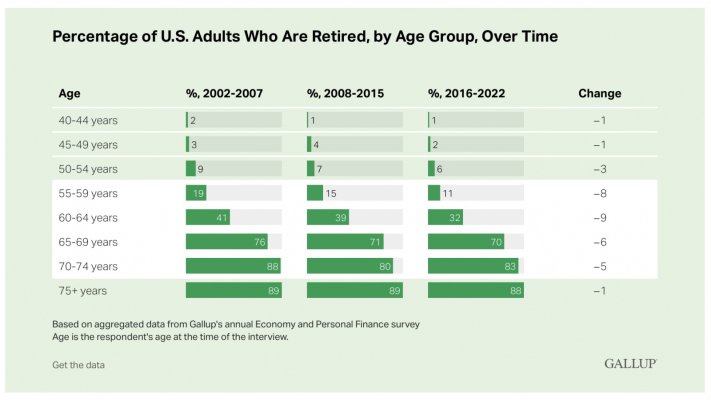

That poll is worded a bit tricky though. It might make you think that the average retirement age in 1991 was 57. However, what it's really saying is that the average retiree who answered that poll in 1991, had retired at the age of 57.