BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 892

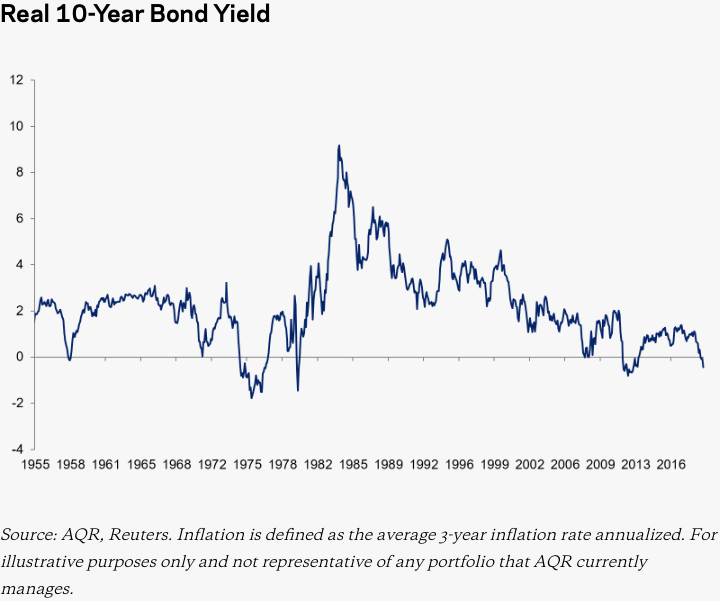

So I have been having thoughts in the last year, that a normal conservative AA of 50/50 or 70/30 is no longer appropriate when it is clear we will have negative real rates for many years to come.... and passive strategies around equities at current valuations could lead to a "lost decade' type of situation.

I view (in USA) both bonds and equities are largely over valued, and have switched from passive to active, where I can see more value and manage risk by looking at cash flows etc of individual equities or debt offerings.

Is anyone else changing their strategy because they feel the passive train is running out of steam and switching to active? Is anyone moving to more equities because they feel real yields will stay negative?

I view (in USA) both bonds and equities are largely over valued, and have switched from passive to active, where I can see more value and manage risk by looking at cash flows etc of individual equities or debt offerings.

Is anyone else changing their strategy because they feel the passive train is running out of steam and switching to active? Is anyone moving to more equities because they feel real yields will stay negative?