pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

....Is the distribution auto adjusted for Inflation (~2.3%) ? Since it's a fund I'd think old bonds are expiring and new ones are being bought at current rates so it should be auto adjusted for Inflation. ...

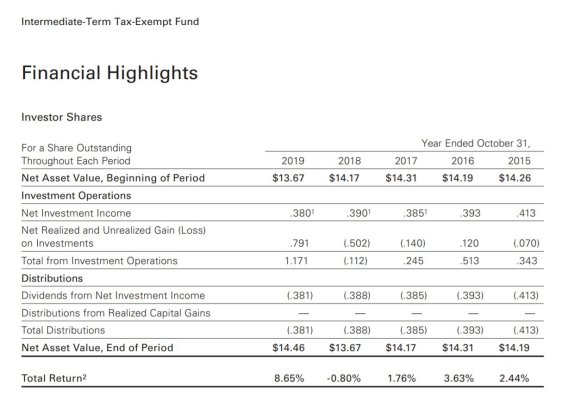

No, fund distributions don't work that way. Most are simply a distribution of income received less expenses to shareholders. You can see this if you look at a fund's annual report. See clip from Vanguard Intermediate-Term Tax-Exempt Fund below and note that distributions approximate interest income.

If distributions increase consistent with inflation it is merely coincidental, not by design.