pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

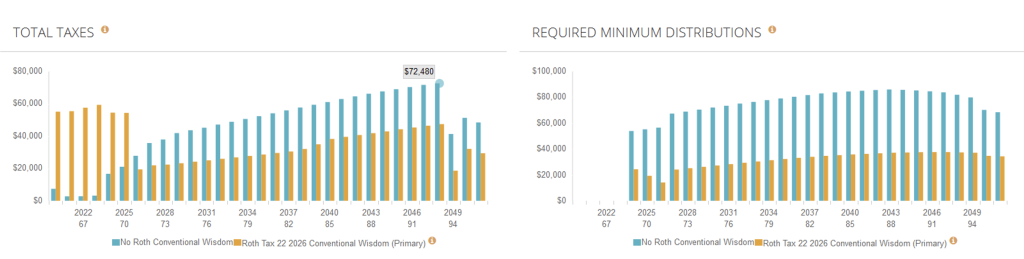

The big opportunity for Roth converisions is betwen when you stop working and when pensions if any, SS and RMDs start. Typically, dutring those years you are in a lo tax bracket. The biggest bang for the buck is where you can arbitrage between 12% and 22%. If your situation is to pay 22% now to save 24% later then Roth conversions are much less compelling.