exnavynuke

Thinks s/he gets paid by the post

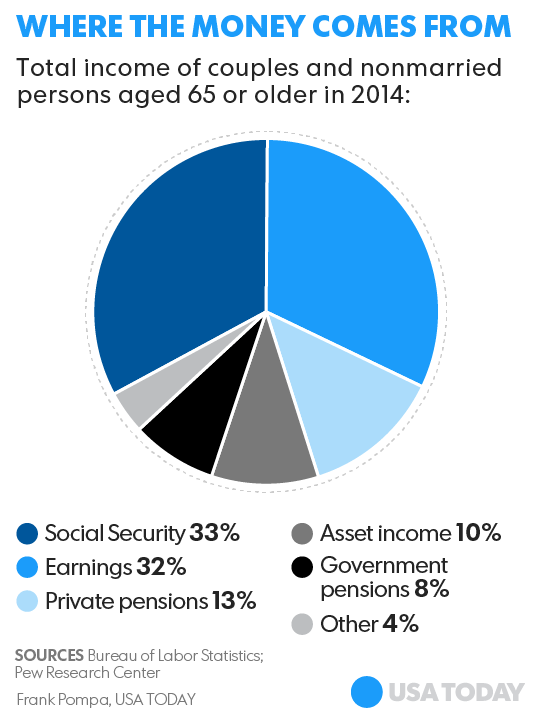

This isn't directly related (as it's total income and not an average), but I thought it fairly relevant to the discussions in this thread.

I took it to mean that only 8% are getting government pensions but I could be wrong)

Wasn't sure how to answer. I had a mega corp pension which I took as a lump sum. ...

Really amazed at the number of people here who have pensions. I'm 53, work in high tech and know virtually no-one with a traditional pension (including DW and me).

What do all you people DO for a living? Seriously!! Are you all .GOV? Teachers? Auto workers? Mail delivery?

Being 62, it was common when I started work to have pensions in big corps. My early Boeing pension was cashed out, but my Scott Paper one got capped and I was able to draw it enhanced at 55. As KCC acquired SPC, they enhanced the 401K plan to compensate partly, but did not offer an ongoing pension plan other than the former one from SPC. My Ionics pension I just qualified under the 5 year rule as GE bought them out, but GE continued a new pension plan for those acquired giving me two under GE rules, but not with the same perks as longer term GE pre-merger folks. That plan also had limits, and I believe the trend has been to eliminate pension plans to shorter term employees. OTOH, my wife has only one "pension" from the university under a state PERS2 option, but they also provided for her to pay into SS, and had a TIAA Annuity plan as well, which is like a liquid pension.

Being 62, it was common when I started work to have pensions in big corps. My early Boeing pension was cashed out, but my Scott Paper one got capped and I was able to draw it enhanced at 55. As KCC acquired SPC, they enhanced the 401K plan to compensate partly, but did not offer an ongoing pension plan other than the former one from SPC. My Ionics pension I just qualified under the 5 year rule as GE bought them out, but GE continued a new pension plan for those acquired giving me two under GE rules, but not with the same perks as longer term GE pre-merger folks. That plan also had limits, and I believe the trend has been to eliminate pension plans to shorter term employees. OTOH, my wife has only one "pension" from the university under a state PERS2 option, but they also provided for her to pay into SS, and had a TIAA Annuity plan as well, which is like a liquid pension.

Really amazed at the number of people here who have pensions. I'm 53, work in high tech and know virtually no-one with a traditional pension (including DW and me).

What do all you people DO for a living? Seriously!! Are you all .GOV? Teachers? Auto workers? Mail delivery?

Really amazed at the number of people here who have pensions. I'm 53, work in high tech and know virtually no-one with a traditional pension (including DW and me).

What do all you people DO for a living? Seriously!! Are you all .GOV? Teachers? Auto workers? Mail delivery?

Very envious but do think this is a skewed sample. OF COURSE people who can RE have pensions. The rest of us slugs have had to save in our piggy banks to a point we can even 'think' about RE, and it's infinitely harder to do so if you don't have all these wonderful golden benefits to help out..

What do all you people DO for a living? Seriously!! Are you all .GOV? Teachers? Auto workers? Mail delivery?

Really amazed at the number of people here who have pensions. I'm 53, work in high tech and know virtually no-one with a traditional pension (including DW and me).

What do all you people DO for a living? Seriously!! Are you all .GOV? Teachers? Auto workers? Mail delivery?

Very envious but do think this is a skewed sample. OF COURSE people who can RE have pensions. The rest of us slugs have had to save in our piggy banks to a point we can even 'think' about RE, and it's infinitely harder to do so if you don't have all these wonderful golden benefits to help out..

Really amazed at the number of people here who have pensions. I'm 53, work in high tech and know virtually no-one with a traditional pension (including DW and me).

What do all you people DO for a living? Seriously!! Are you all .GOV? Teachers? Auto workers? Mail delivery?

Very envious but do think this is a skewed sample. OF COURSE people who can RE have pensions. The rest of us slugs have had to save in our piggy banks to a point we can even 'think' about RE, and it's infinitely harder to do so if you don't have all these wonderful golden benefits to help out..

Uh, no, I'm not a mailman?

Since private pensions were being frozen and/or cratering right and left when it came time for me to choose a career path years ago, I turned down a job offer for $160K/year with private industry. Instead I took a less challenging, less prestigious, but more secure job with a compensation package including a five figure income and better benefits, with the federal government. Many techie people have this sort of choice, but it's easy to lose track of one's goals and go for the immediate $$.

http://www.early-retirement.org/forums/f30/what-do-you-do-for-a-living-74628.html

Similarly, I work for a megacorp that offered traditional non-colad pension starting with them in 1985. I had opportunities to job-shop for big $$$ off and on in the first 15 years. Then i got in on the front end with a new software vendor from India that was aboutvto explode. At one time I was THE expert on this tool in the US. The owner of that company invited me to dinner about 9 years ago and me an exciting offer which included a big jump in salary, work from home with some travel and the choice of %ownership with profit sharing or even higher salary.In the early years of tech (70s and 80s), many IT companies offered pensions. However, it was uncommon for folks to stay with one company since demand outstripped supply and hopping from company to company was the way to get raises. I chose to stay with Megacorp, so I had enough years to keep it when Megacorp changed their policy. But I also benefited from stock options/equity rewards, after this change, though not as much as newer Megacorp employees (which is fine with me).

I had opportunities to leave for more risk/reward, but chose not to. I have friends who moved around and are now probably worth hundreds of millions... and others who left and are far worse off. I'm happy being in the middle.