capjak

Full time employment: Posting here.

This is the email alert I got:

Fixed Income Full Call Alert

Fidelity Investments.

Legal Information

Fidelity would like to inform you of an event that will occur on one of the securities which you hold in your portfolio.

The below security was affected by a Full Call.

CUSIP: 02361D852

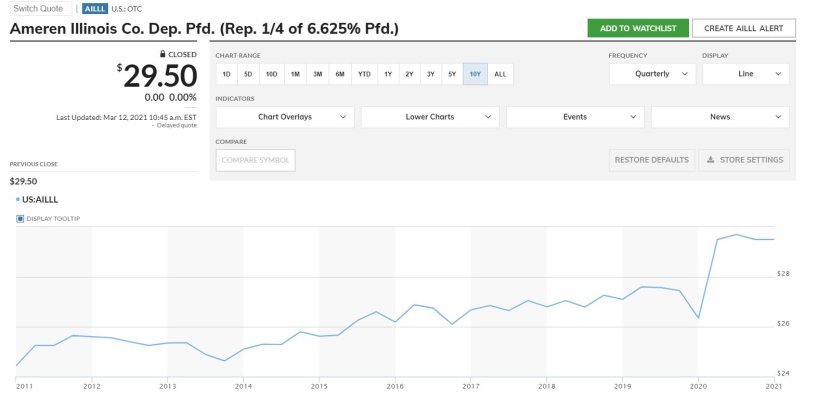

Description: AMEREN ILL CO PFD 1/4 6.62500%

Rate: 0.000%

Maturity Date:

Quantity:

Redemption Price: 25.00

Redemption Principal:

Call Date: 2021-03-29

To discuss your investment or other fixed income opportunities, please visit Fidelity.com, visit your local Investor Center or call 800-544-5372.

Fixed Income Full Call Alert

Fidelity Investments.

Legal Information

Fidelity would like to inform you of an event that will occur on one of the securities which you hold in your portfolio.

The below security was affected by a Full Call.

CUSIP: 02361D852

Description: AMEREN ILL CO PFD 1/4 6.62500%

Rate: 0.000%

Maturity Date:

Quantity:

Redemption Price: 25.00

Redemption Principal:

Call Date: 2021-03-29

To discuss your investment or other fixed income opportunities, please visit Fidelity.com, visit your local Investor Center or call 800-544-5372.