FIREmenow

Full time employment: Posting here.

- Joined

- May 9, 2013

- Messages

- 756

I did some, granted rudimentary, searching and didn't see anything related to this.

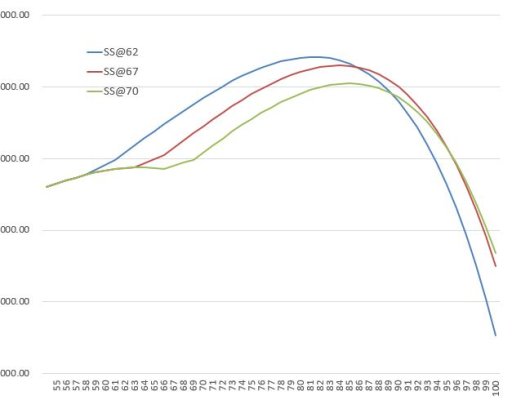

In your forecast projections for after retirement, do you assume the increases year-over-year in social security is the same % as the inflation rate eating away at your investments/income?

Seems firecalc uses the same number for each?

Or do you offset them somewhat? I am currently using 3% inflation for investments/income, and 2% for SS increases.

Does this make sense? Anyone already retired for some period have any real data saying one thing or another?

Leaving healthcare out of it for now.....

In your forecast projections for after retirement, do you assume the increases year-over-year in social security is the same % as the inflation rate eating away at your investments/income?

Seems firecalc uses the same number for each?

Or do you offset them somewhat? I am currently using 3% inflation for investments/income, and 2% for SS increases.

Does this make sense? Anyone already retired for some period have any real data saying one thing or another?

Leaving healthcare out of it for now.....