Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

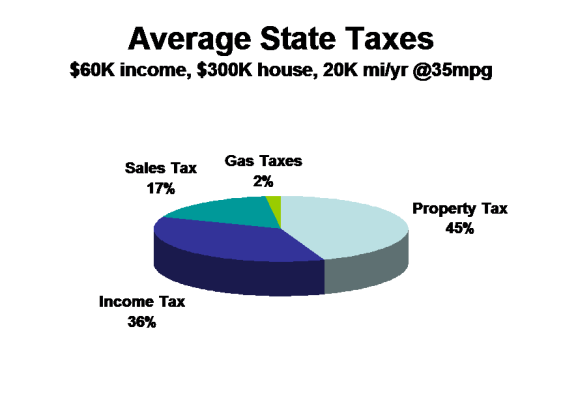

With relocation in the picture, I refer to several though most are "static" and therefore less useful. I thought this one was worth sharing as it:

FWIW

State Tax Comparison Table

- includes state income, sales, property & gas taxes and

- you can vary income, grocery, property value & miles driven

FWIW

State Tax Comparison Table

| Rank | State | Tot Tax |

| 1 | Nebraska | $9,377 |

| 2 | Wisconsin | $9,303 |

| 3 | Connecticut | $8,370 |

| 4 | Vermont | $8,321 |

| 5 | Kansas | $8,204 |

| 6 | New Jersy | $8,115 |

| 7 | Michigan | $7,937 |

| 8 | Iowa | $7,766 |

| 9 | Illinois | $7,621 |

| 10 | New York | $7,539 |

| 11 | Maine | $7,528 |

| 12 | Washington, D.C. | $7,432 |

| 13 | Minnesota | $7,426 |

| 14 | Rhode Island | $7,423 |

| 15 | Pennsylvania | $7,341 |

| 16 | Idaho | $7,197 |

| 17 | North Carolina | $7,128 |

| 18 | Massachusetts | $7,051 |

| 19 | Oregon | $7,007 |

| 20 | Ohio | $6,927 |

| 21 | Texas | $6,610 |

| 22 | Kentucky | $6,529 |

| 23 | North Dakota | $6,490 |

| 24 | California | $6,423 |

| 25 | South Carolina | $6,357 |

| 26 | Georgia | $6,244 |

| 27 | Indiana | $6,231 |

| 28 | Virginia | $6,200 |

| 29 | Missouri | $6,162 |

| 30 | Utah | $6,159 |

| 31 | Oklahoma | $6,102 |

| 32 | Arkansas | $6,044 |

| 33 | Montana | $5,953 |

| 34 | Maryland | $5,945 |

| 35 | Hawaii | $5,823 |

| 36 | Mississippi | $5,700 |

| 37 | West Virginia | $5,664 |

| 38 | New Hampshire | $5,118 |

| 39 | South Dakota | $4,996 |

| 40 | New Mexico | $4,808 |

| 41 | Colorado | $4,753 |

| 42 | Arizona | $4,424 |

| 43 | Alabama | $4,326 |

| 44 | Delaware | $4,115 |

| 45 | Washington | $3,910 |

| 46 | Tennessee | $3,856 |

| 47 | Florida | $3,738 |

| 48 | Alaska | $3,212 |

| 49 | Nevada | $3,092 |

| 50 | Louisiana | $2,916 |

| 51 | Wyoming | $2,586 |

Last edited: