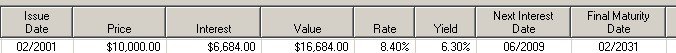

11 years ago I purchased I bonds and presently receiving about 5.5% rate and have not redeemed them yet. I am now looking to increase my bond allocation in a taxable account since I have maxed out my tax deferred accounts and wanted to know if now may be a good time to purchase more.

I did have a few questions.

1. On my previous purchase I bought in $1,000 denominations and wanted to see if I should go with a higher denomination. I know that only $10,000 can be purchased a year.

2. I am 55 years old and doubt if I will hold them the full 30 years, but will hold them at least five so no loss of interest and I do have an emergency fund already set up as well as my previous bond purchase. Is 55 too old to purchase?

3. My old bonds are in paper form. Is it better to convert to electronic? If not, how easy is it to redeem them?

4. I believe I read somewhere that EE bonds might be a better alternative. Any thoughts on this?

Thank you.

I did have a few questions.

1. On my previous purchase I bought in $1,000 denominations and wanted to see if I should go with a higher denomination. I know that only $10,000 can be purchased a year.

2. I am 55 years old and doubt if I will hold them the full 30 years, but will hold them at least five so no loss of interest and I do have an emergency fund already set up as well as my previous bond purchase. Is 55 too old to purchase?

3. My old bonds are in paper form. Is it better to convert to electronic? If not, how easy is it to redeem them?

4. I believe I read somewhere that EE bonds might be a better alternative. Any thoughts on this?

Thank you.