Blue Collar Guy

Thinks s/he gets paid by the post

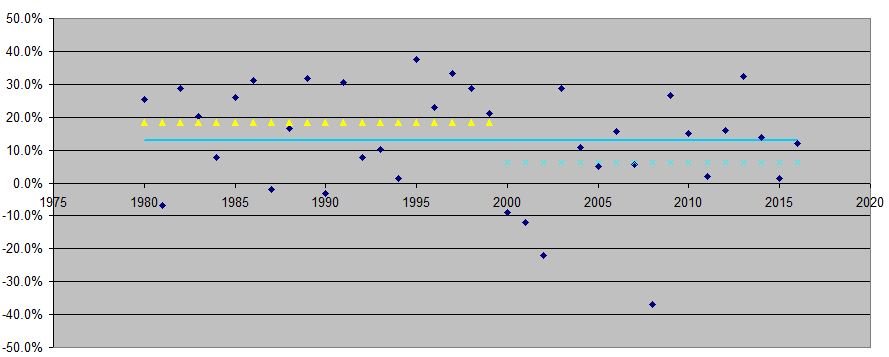

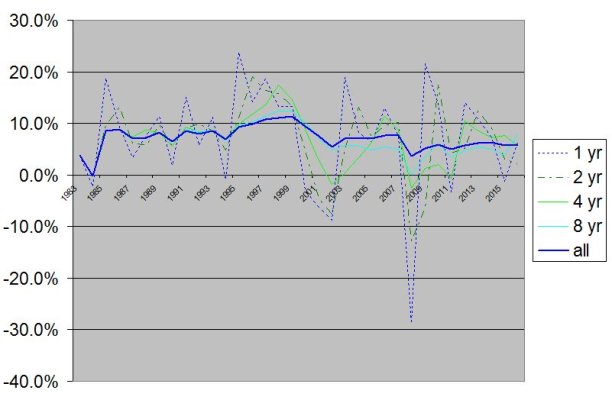

For the forum members that were investing in mutual funds since 1980, I read the market averaged 16% plus for 18 years. Thats a long run. Did you stay the course? Did you re-balance? Did you cash out? Change your AA? If you remember, did you find the yearly returns unbelievable?

This question arose when I was in another thread doing the YTD change. Its over 10 %, but the dollar amount is staggering. Imagine 18 years at 16%?

This question arose when I was in another thread doing the YTD change. Its over 10 %, but the dollar amount is staggering. Imagine 18 years at 16%?

But in my late 20's and early 30's it sounded like a plan.

But in my late 20's and early 30's it sounded like a plan.