street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,600

This maybe a very stupid question and it may have been talked about here but have not seen it.

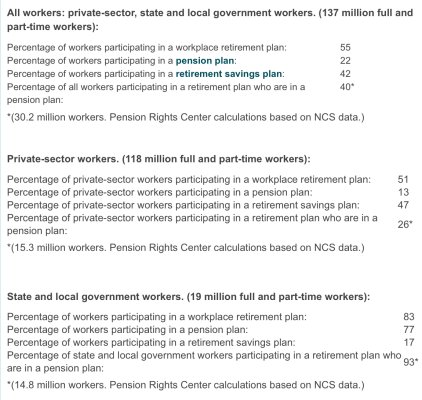

A company that has a pension plan for their employees does the market have much effect on that plan? So, in all these good time of rising markets will their pension plan change with the up and down of the markets or is that plan directed toward an end point regardless of change in markets.?

Thanks

A company that has a pension plan for their employees does the market have much effect on that plan? So, in all these good time of rising markets will their pension plan change with the up and down of the markets or is that plan directed toward an end point regardless of change in markets.?

Thanks