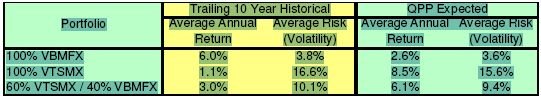

Using historical/"look back" versus "plan ahead" mode in the portfolio section produces very different results. The user guide states the following:

"Plan Ahead" mode should be used in all retirement planning calculations. Why? Because, prior to1990, the average dividend yield was about 4.5%. Nowadays it is around 2%. If you use the "Look Back" mode you would be building-in unrealistic return rates for your retirement planning.

So the "plan ahead" model ignores many decades of performance data and assumes that the recent poor performance will apply forever? Hmmm. Was this modeled before or after the 2008 crash? Given the crash are more aggressive future returns rational to assume? Transparency to the detailed assumptions is not provided. In the look forward model exactly what total returns are assumed?

Without a better understanding of these very key assumptions I'm not sure how to interpret the results from the plan ahead modeling..

Has anyone gotten into this?

"Plan Ahead" mode should be used in all retirement planning calculations. Why? Because, prior to1990, the average dividend yield was about 4.5%. Nowadays it is around 2%. If you use the "Look Back" mode you would be building-in unrealistic return rates for your retirement planning.

So the "plan ahead" model ignores many decades of performance data and assumes that the recent poor performance will apply forever? Hmmm. Was this modeled before or after the 2008 crash? Given the crash are more aggressive future returns rational to assume? Transparency to the detailed assumptions is not provided. In the look forward model exactly what total returns are assumed?

Without a better understanding of these very key assumptions I'm not sure how to interpret the results from the plan ahead modeling..

Has anyone gotten into this?