For our rural state, I believe our high sales are primarily pandemic driven by lock down/crime escapees. Our state economy has been devastated and will continue to be under this administration so our outlook is not good so no other real good reason to move here unless your already retired. With lock downs again looming elsewhere, I believe our sale prices will stay high for a while longer.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Real Estate Bubble?

- Thread starter Keim

- Start date

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If it is true what is being reported about Californians leaving for other states like Texas, Arizona etc. Why are California prices still in the stratosphere. Just asking.

Willers

Full time employment: Posting here.

- Joined

- May 13, 2013

- Messages

- 730

Just sold our house for what I consider to be an insane price. We're starting to look for a new one and our competition (buyers) here in our part of Colorado appears to be mainly coming from Austin, SF, LA and NY.

Hope it cools a bit so we don't get hammered quite as badly on the buy side. We're downsizing by 50% so that will help. The good sign is that houses with crazy prices per sq. ft. are finally sitting. One "collecting offers" house sold for $100K below asking so the frenzy may be subsiding. Inexpensive homes (defined in our very expensive town as <1.2M for SFH's) still going within 2 days, regardless of condition.

Hope it cools a bit so we don't get hammered quite as badly on the buy side. We're downsizing by 50% so that will help. The good sign is that houses with crazy prices per sq. ft. are finally sitting. One "collecting offers" house sold for $100K below asking so the frenzy may be subsiding. Inexpensive homes (defined in our very expensive town as <1.2M for SFH's) still going within 2 days, regardless of condition.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Problem, is if one sells high in one state, then moved to another state, the RE Tax bill becomes quite high. Tax portability is usually only in State. States do not seem to adjust their tax basis based on market trends, if anything it is the reverse. How can it be sustainable. Other countries that base RE taxes on things other than home sale prices are a lot better in my opinion and keeps things fairer.

jkern

Full time employment: Posting here.

If it is true what is being reported about Californians leaving for other states like Texas, Arizona etc. Why are California prices still in the stratosphere. Just asking.

I believe it's because of immigration, specifically from China and India. The demand is still high even with long term residents moving out.

mrstop

Dryer sheet aficionado

If it is true what is being reported about Californians leaving for other states like Texas, Arizona etc. Why are California prices still in the stratosphere. Just asking.

I believe it's because of immigration, specifically from China and India. The demand is still high even with long term residents moving out.

It's been years since I have looked at the housing demographics of California. If I recall correctly, there is a disproportionately high number of renters. While there may be a net migration out of California, it's possible that renters are turning into home buyers to fill the void.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Problem, is if one sells high in one state, then moved to another state, the RE Tax bill becomes quite high. Tax portability is usually only in State. States do not seem to adjust their tax basis based on market trends, if anything it is the reverse. How can it be sustainable. Other countries that base RE taxes on things other than home sale prices are a lot better in my opinion and keeps things fairer.

It depends on the state and how they provide property tax relief to homeowners.

In states like CA and FL you can indeed have identical homes next door to each other paying very different property taxes because one owner has been there a long time and the other just bought recently. I personally think that is a bit of a crazy approach to property tax relief, especially since the differences can be very extreme.

In Vermont, if you had identical homes next door to each other the assessed values would be the same as would the property tax bills (assuming that both were homestead). Property tax relief is based on household income (rather than how long you have lived there) so if the neighbors had identical household incomes then the property tax credits would be the same.

If the neighbors didn't have identical incomes, the new neighbor could have a lower net property tax bill if their income was lower than their neighbor who had owned their house for a long time.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It depends on the state and how they provide property tax relief to homeowners.

In states like CA and FL you can indeed have identical homes next door to each other paying very different property taxes because one owner has been there a long time and the other just bought recently. I personally think that is a bit of a crazy approach to property tax relief, especially since the differences can be very extreme.

In Vermont, if you had identical homes next door to each other the assessed values would be the same as would the property tax bills (assuming that both were homestead). Property tax relief is based on household income (rather than how long you have lived there) so if the neighbors had identical household incomes then the property tax credits would be the same.

If the neighbors didn't have identical incomes, the new neighbor could have a lower net property tax bill if their income was lower than their neighbor who had owned their house for a long time.

Yep bought our home in 2019 and are paying 2k more in property taxes than some friends with similar houses bought in 2006.

At least the yearly tax increase can only be a maximum of 3%.

retire to nature

Recycles dryer sheets

- Joined

- Aug 10, 2018

- Messages

- 383

If it is true what is being reported about Californians leaving for other states like Texas, Arizona etc. Why are California prices still in the stratosphere. Just asking.

i believe so many fires and loss of house are affecting.

Over the past decade only 3 states have seen a decline in population, Illinois (-.01%), Mississippi (-.02%) and West Virginia (-3.2%). The rest have all seen population growth, according to the US Census (here)

There is undoubtedly lots of dynamics in those numbers, with younger people moving to the high income / high cost of living states as retirees leave, looking for a lower cost of living retirement. The driving factor for such high real estate prices in New York and California is working age population has increased while housing has not. In those areas there isn’t enough housing, not enough new residences are built, and new housing favors single family units when high-rise and multi-family units are clearly a more compelling need.

There is undoubtedly lots of dynamics in those numbers, with younger people moving to the high income / high cost of living states as retirees leave, looking for a lower cost of living retirement. The driving factor for such high real estate prices in New York and California is working age population has increased while housing has not. In those areas there isn’t enough housing, not enough new residences are built, and new housing favors single family units when high-rise and multi-family units are clearly a more compelling need.

retire to nature

Recycles dryer sheets

- Joined

- Aug 10, 2018

- Messages

- 383

Over the past decade only 3 states have seen a decline in population, Illinois (-.01%), Mississippi (-.02%) and West Virginia (-3.2%). The rest have all seen population growth, according to the US Census (here)

There is undoubtedly lots of dynamics in those numbers, with younger people moving to the high income / high cost of living states as retirees leave, looking for a lower cost of living retirement. The driving factor for such high real estate prices in New York and California is working age population has increased while housing has not. In those areas there isn’t enough housing, not enough new residences are built, and new housing favors single family units when high-rise and multi-family units are clearly a more compelling need.

not sure it is including pandemic time. statistic is delayed usually. I am afraid the number of death would affect to housing crash. but like i mentioned in another reply, fire or nature disaster is ruining houses alot too because global warming.

If it is true what is being reported about Californians leaving for other states like Texas, Arizona etc. Why are California prices still in the stratosphere. Just asking.

Internal supply and demand.....and timing. If you sold your house to move within CA, you only have very few homes on the market to choose from, and prices keep rising.

The exodus is greatly exaggerated. Only 88,000 people left California's four most populated cities in 2020. That's just a blip on the radar; and it's much more relevant to know that our population grew by over 2.5 million between 2010 and 2020. That's a lot of people - almost the entire population of Kansas!

Although the expats get all the news, lot of people in CA are moving from HCOL to LCOL areas within the state due to remote work opportunities and quality of life issues. Lake Tahoe, for one, has been blowing up the past year. So have the remote Riverside/San Diego suburbs like Temecula and Hemet. Builders are building there like crazy, but can't keep up.

If necessary, the purchaser's cash [from the sale of their own property] can be leveraged with very low-interest mortgages; so bidding wars are inevitable, since there are few alternatives. Some Buyers also can take advantage of a one-time CA property tax break that allows them to transfer the tax basis from their current primary residence to another residence of higher value.

Teacher Terry

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 17, 2014

- Messages

- 7,100

Californians are mostly responsible for the growth of Nevada. Our real estate and renting are becoming unaffordable for the locals. Luckily I bought a condo when I first moved here 24 years ago so have always owned real estate.

firemediceric

Recycles dryer sheets

- Joined

- Aug 9, 2017

- Messages

- 207

House we purchased in 2012 for $265K that we put another $40K plus into was sold 12/19 for $425K. I thought that was a healthy profit. The people who bought the house now have it listed for $699K. It doesn't appear they have done anything to the house in the way of improvements. As I write this the house has been sitting on the market for over 40 days now, so perhaps their asking price is a little too ambitious.

snowboarder

Dryer sheet aficionado

- Joined

- Mar 5, 2019

- Messages

- 38

House we purchased in 2012 for $265K that we put another $40K plus into was sold 12/19 for $425K. I thought that was a healthy profit. The people who bought the house now have it listed for $699K. It doesn't appear they have done anything to the house in the way of improvements. As I write this the house has been sitting on the market for over 40 days now, so perhaps their asking price is a little too ambitious.

Yes the tables are turning now. Buyers are going on strike but what no one is talking about is how banks have become even more strict with the mortgage loans.

Mortgage applications have dropped in the past 2 months. Banks are holding the bag for all those people in forebearance who haven't paid a dime in over a year. Once these moratoriums end once and for all we'll see a deluge of these people trying to offload their homes. I used to think we were not in a bubble but the more research I do, the more I think we are.

Last edited:

daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

If it is true what is being reported about Californians leaving for other states like Texas, Arizona etc. Why are California prices still in the stratosphere. Just asking.

"In fact, more wealthy people are moving to California than leaving, research indicates. It’s the poor and middle class who are departing...California has a net out-migration of low-income folks who can’t afford to live in their state and are being pushed out by high-income homeowners. ."

https://napavalleyregister.com/opin...cle_4035dbda-3df7-5586-aaa7-cbab3781963c.html

Last edited:

Major Tom

Thinks s/he gets paid by the post

Here you go. For $300K, you can buy a 240 sq ft shipping container "home" in the middle of the desert, in Joshua Tree, CA. It is not yet connected to a septic system, and appears to not be connected the electric grid either. There is a "water meter on the property", meaning that the "home" is not actually connected to the water supply. Also, it "needs to be set on a foundation". Looks like somebody's failed project. It's speculative listings like this which signal to me that the peak of the market, at least in this area, is most likely not too far off.

(This is a link to a property listing on Zillow. Hopefully, this description will satisfy the requirements of the group rules against posting naked links.)

https://www.zillow.com/homedetails/5021-Center-Ave-Joshua-Tree-CA-92252/2069269434_zpid/

(This is a link to a property listing on Zillow. Hopefully, this description will satisfy the requirements of the group rules against posting naked links.)

https://www.zillow.com/homedetails/5021-Center-Ave-Joshua-Tree-CA-92252/2069269434_zpid/

Last edited:

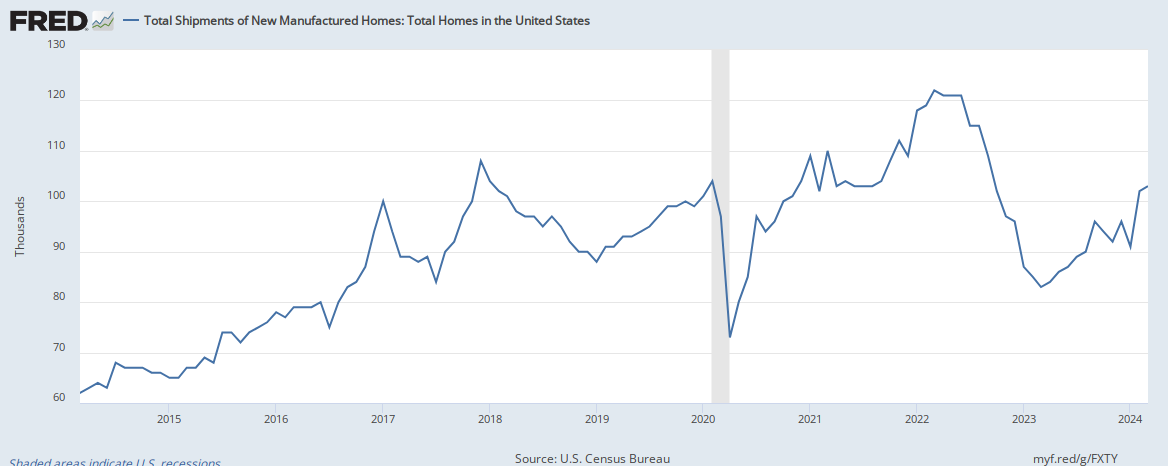

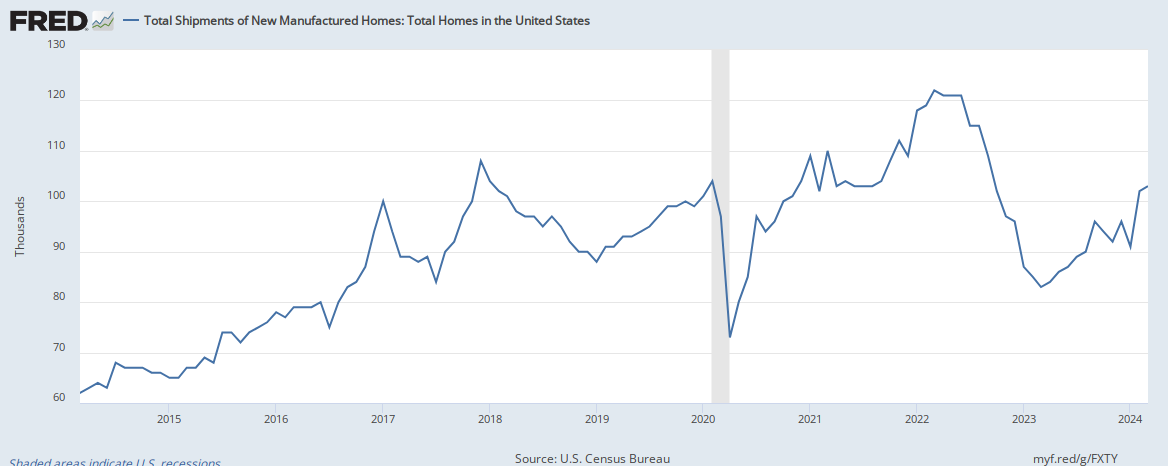

What's up with the manufactured housing industry? Something changed in this industry post-GFC. This is not a 2020 thing, it's a 10 year+ trend.

Currently on a 10 year growth trend, but 20 years ago production volume was much higher, and 50 years ago even higher. Are consumers preferring manufactured homes vs stick built, in relative terms?

Currently on a 10 year growth trend, but 20 years ago production volume was much higher, and 50 years ago even higher. Are consumers preferring manufactured homes vs stick built, in relative terms?

aja8888

Moderator Emeritus

Here you go. For $300K, you can buy a 240 sq ft shipping container "home" in the middle of the desert, in Joshua Tree, CA. It is not yet connected to a septic system, and appears to not be connected the electric grid either. There is a "water meter on the property", meaning that the "home" is not actually connected to the water supply. Also, it "needs to be set on a foundation". Looks like somebody's failed project. It's speculative listings like this which signal to me that the peak of the market, at least in this area, is most likely not too far off.

(This is a link to a property listing on Zillow. Hopefully, this description will satisfy the requirements of the group rules against posting naked links.)

https://www.zillow.com/homedetails/5021-Center-Ave-Joshua-Tree-CA-92252/2069269434_zpid/

Tom, it's on 5 acres! Suitable for development and future rental income. How can you go wrong?

ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Here you go. For $300K, you can buy a 240 sq ft shipping container "home" in the middle of the desert, in Joshua Tree, CA. It is not yet connected to a septic system, and appears to not be connected the electric grid either. There is a "water meter on the property", meaning that the "home" is not actually connected to the water supply. Also, it "needs to be set on a foundation". Looks like somebody's failed project. It's speculative listings like this which signal to me that the peak of the market, at least in this area, is most likely not too far off.

(This is a link to a property listing on Zillow. Hopefully, this description will satisfy the requirements of the group rules against posting naked links.)

https://www.zillow.com/homedetails/5021-Center-Ave-Joshua-Tree-CA-92252/2069269434_zpid/

But, but...it's a "Brand new Farmhouse container home." Almost as bad as "classic modern rustic."

Yes the tables are turning now. Buyers are going on strike but what no one is talking about is how banks have become even more strict with the mortgage loans.

Mortgage applications have dropped in the past 2 months. Banks are holding the bag for all those people in forebearance who haven't paid a dime in over a year. Once these moratoriums end once and for all we'll see a deluge of these people trying to offload their homes. I used to think we were not in a bubble but the more research I do, the more I think we are.

I’ve been wondering about this for a while. The government has been propping up renters and mortgage holders but there has to be a cliff coming. When?

Also I’ve heard that banks may allow those in arrears on mortgages to add on the balance to the end of their term. Anyone savvy about that plan?

snowboarder

Dryer sheet aficionado

- Joined

- Mar 5, 2019

- Messages

- 38

I’ve been wondering about this for a while. The government has been propping up renters and mortgage holders but there has to be a cliff coming. When?

Also I’ve heard that banks may allow those in arrears on mortgages to add on the balance to the end of their term. Anyone savvy about that plan?

Yeah banks are pushing the omitted payments towards the end of the loan term, but once you have to resume regular payments there is no more free lunch. Watch this guy and draw your own conclusions. He uses real data to illustrate his points not just anecdotal data.

BANKS Predicting HOUSING CRASH in 2021

Last edited:

teejayevans

Thinks s/he gets paid by the post

- Joined

- Sep 7, 2006

- Messages

- 1,692

I question what percentage of the buyers are transitory, I have a hard time believing they are significant segment of the buying market.

I question what percentage of the buyers are transitory, I have a hard time believing they are significant segment of the buying market.

You would be surprised. Lot of cash buyers on the lower end. Higher end houses are still going to high income end users. Middle of the road houses finding ways to good credit end users. Everyone without pristine credit are priced out of the market. I had couple of tenants like that who ended up moving with their family while they find a home they can afford.

PS: I personally know two cash buyers who are still buying at these prices. I even know an empty nester with 4500 sqft house who upgraded to luxury 6000 sqft house (using 401k funds +old equity). Empty nester is betting on price appreciation!

no

no

Last edited:

Similar threads

- Replies

- 5

- Views

- 801

- Replies

- 21

- Views

- 3K