Your Dad is claiming the same exemption as MFJ, without being a “qualifying widower”? On what basis? The current tax code does’t allow that after 2 years from date of death of the spouse?

As far as tax brackets, are you also saying your Dad’s tax brackets are also those for married filing jointly?

My Mom’s tax preparer has her neither claiming MFJ for her deduction(Dad passed away in 2010) nor calculating her taxes based on the MFJ.

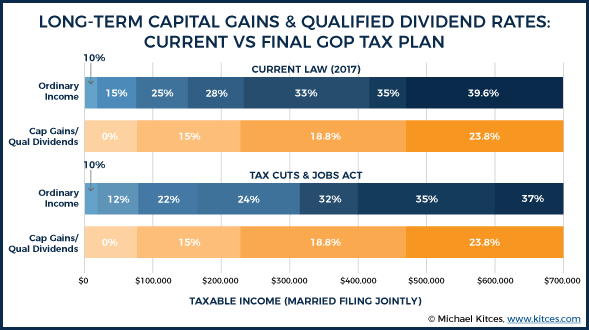

My interpretation that surviving spouses, under the new code if approved, would enjoy the MFJ deduction and brackets, is based on the language in the joint reconciliation document released Friday night, as it clearly states that the standard deduction and tax brackets for MFJ also include “surviving spouses”, as opposed to “qualified widowers”, a significantly different definition. I realize, that once the final language in the soon to be new code is finalized, that the language could revert to “qualifing widowers”, but for now, it would seem from the proposed language, that surviving spouses will have the same deduction as MFJ, and same tax brackets as MFJ.