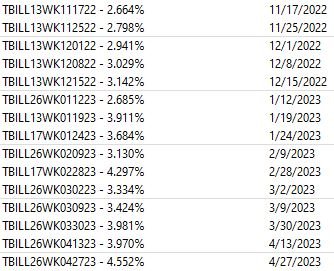

So, I want to buy some 3 month treasuries. The next auction is Monday.

For whatever reason, they can't be purchased on Fidelity at this moment (maybe later today?). Anyway, you can buy a 6 month treasury (auction date Monday) that is reopened from 3 months ago. Given they will mature in 3 months, they are essentially the same thing as a new 3 month bill.

So, what's the difference between the two? Is there any reason to prefer one over the other?

Thanks.

For whatever reason, they can't be purchased on Fidelity at this moment (maybe later today?). Anyway, you can buy a 6 month treasury (auction date Monday) that is reopened from 3 months ago. Given they will mature in 3 months, they are essentially the same thing as a new 3 month bill.

So, what's the difference between the two? Is there any reason to prefer one over the other?

Thanks.