Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Did you guys see the story about this kid in Illinois that thought he lost $700k in his Robinhood account and committed suicide? Horrible

Sad.

Although in one of my brokerages, I had my heart skip a beat or two when I first logged in one day as it shows Options I bought and the amount I'm missing out on when I wrote a call and the price leapfrogged up.

A big -$xxxxxx

It did take me a second to realize I was only missing out on potential money and NOT losing real money.

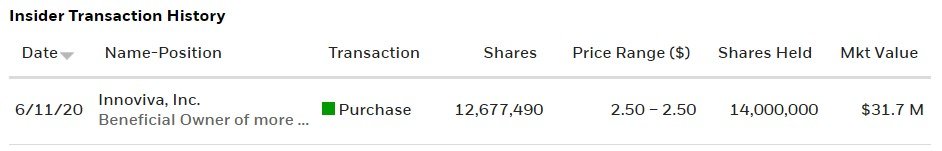

I'll have a look at ETTX

I'll have a look at ETTX